City of Lakewood financials

Moderator: Jim O'Bryan

-

todd vainisi

- Posts: 356

- Joined: Sun Feb 09, 2014 8:41 am

City of Lakewood financials

ww.onelakewood.com/wp-content/uploads/2016/02/City-of-Lakewood-Financial-Overview-History-2009-2018.pdf?fbclid=IwAR20U7XqKL6G__f82kRzlDmrdKhxFdG7faYJnHeGugHtwn49f3ExJ52lG7M

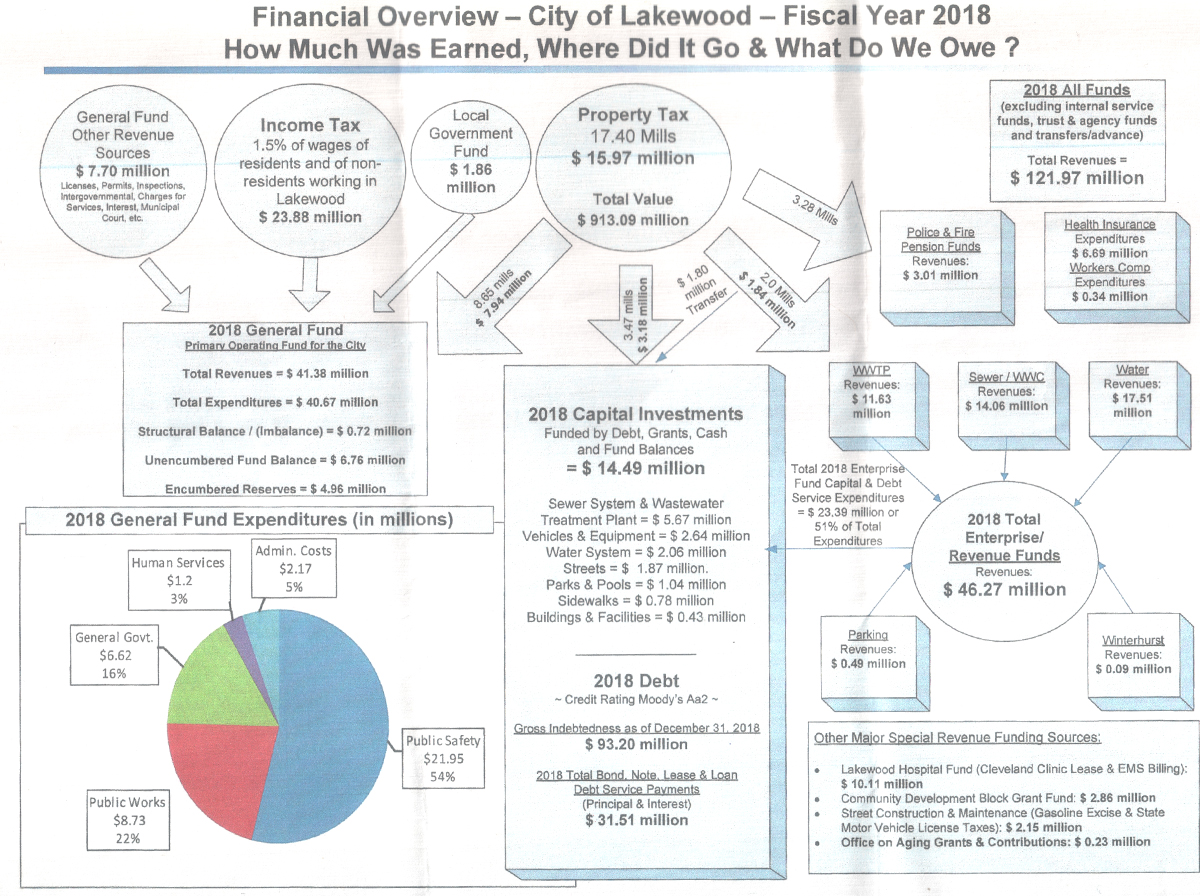

Does this show that our income tax hasn't taken nearly the hit that we have been warned about in regards to the loss of all the hospital staff? I thought it was a pretty staggering number. Anyone care to comment on their own reading of these numbers - i am a novice so I don't know that much about what I'm looking at.

Does this show that our income tax hasn't taken nearly the hit that we have been warned about in regards to the loss of all the hospital staff? I thought it was a pretty staggering number. Anyone care to comment on their own reading of these numbers - i am a novice so I don't know that much about what I'm looking at.

-

Bridget Conant

- Posts: 2896

- Joined: Wed Jul 26, 2006 4:22 pm

Re: City of Lakewood financials

Found this on a web page.

As always, someone well versed in analyzing financial statements can probably provide better insight into the figures and if there are manipulations that can obscure not so favorable data.

Finance Director Jennifer Pae said in a statement. “Despite the end of inpatient services at Lakewood Hospital and New York Life offices moving to downtown Cleveland, the city’s income taxes remain steady due to increased wages, new companies and new residences.”

As always, someone well versed in analyzing financial statements can probably provide better insight into the figures and if there are manipulations that can obscure not so favorable data.

-

Mark Kindt

- Posts: 2647

- Joined: Sat Dec 03, 2016 11:06 am

Re: City of Lakewood financials

Here is the PDF copy of the document.

- Attachments

-

- City-of-Lakewood-Financial-Overview-History-2009-2018.pdf

- (112.36 KiB) Downloaded 242 times

-

Mark Kindt

- Posts: 2647

- Joined: Sat Dec 03, 2016 11:06 am

Re: City of Lakewood financials

Off-Book Assets Versus On-Book Revenues

It is my position that the manner in which revenues are being reported from the Master Agreement between 2015 and 2018 while accurate, materially overstates the actual value of such revenues.

(However, this reporting may be consistent with public fund accounting standards. I have reviewed this issue previously in "Measuring The Damages").

This is best exemplified by the sale of 850 Columbia Road that may, in fact, have had a significant net negative loss value than the revenue reported by the City.

This is the problem with a municipality holding significant "off-book" assets and contract rights. It leads to fluky accounting.

The real book value of 850 Columbia sits on LHA books, not the City's books. However, it is clear from the public documents that the City was being paid from the discounted sale value of that property.

Conceivably, what is being reported as an $6.6M revenue gain by the City could more likely have been an actual loss sale had the asset actually been reported on the City's books, not LHA's.

The losses in lease revenues and employee income tax revenues from the closure of the hospital are real, as well as are certain additional costs associated with EMS resulting from closure.

Some of the revenues reported between 2015 and 2018 from the closure of the hospital may be artificial or accounting artifacts related to City assets (the medical building, the parking garage, 850 Columbia) not carried on the City's books.

The document "papers-over" actual revenue losses by reporting artificial gains stemming from “off-book versus on-book” accounting variations.

The City of Lakewood took a complete bath on the liquidation of its hospital.

The City is giving the hospital away for $1.00.

Are they nuts?

It is my position that the manner in which revenues are being reported from the Master Agreement between 2015 and 2018 while accurate, materially overstates the actual value of such revenues.

(However, this reporting may be consistent with public fund accounting standards. I have reviewed this issue previously in "Measuring The Damages").

This is best exemplified by the sale of 850 Columbia Road that may, in fact, have had a significant net negative loss value than the revenue reported by the City.

This is the problem with a municipality holding significant "off-book" assets and contract rights. It leads to fluky accounting.

The real book value of 850 Columbia sits on LHA books, not the City's books. However, it is clear from the public documents that the City was being paid from the discounted sale value of that property.

Conceivably, what is being reported as an $6.6M revenue gain by the City could more likely have been an actual loss sale had the asset actually been reported on the City's books, not LHA's.

The losses in lease revenues and employee income tax revenues from the closure of the hospital are real, as well as are certain additional costs associated with EMS resulting from closure.

Some of the revenues reported between 2015 and 2018 from the closure of the hospital may be artificial or accounting artifacts related to City assets (the medical building, the parking garage, 850 Columbia) not carried on the City's books.

The document "papers-over" actual revenue losses by reporting artificial gains stemming from “off-book versus on-book” accounting variations.

The City of Lakewood took a complete bath on the liquidation of its hospital.

The City is giving the hospital away for $1.00.

Are they nuts?

-

Mark Kindt

- Posts: 2647

- Joined: Sat Dec 03, 2016 11:06 am

Re: City of Lakewood financials

Multi-million Dollar Payments To Others Are Invisible

The City entered into a Master Agreement that liquidated the City's ownership interest in its leased hospital business and disposed of certain real property assets as well.

Using public information related to that liquidation and the reported distribution of the proceeds from the liquidation, I have estimated the value of that liquidation to be in the range of $175M to $200M.

Because these assets were held "off-book" by the City, most of the liquidated proceeds are "invisible" in the official public accounting.

For example, millions of dollars of liquidated proceeds are being paid to the Healthy Lakewood Foundation from the liquidation of the hospital and those millions will never appear on the City's books.

This may be a good thing or it may be a bad thing, but whatever it is, it is not transparent to the citizenry.

The City entered into a Master Agreement that liquidated the City's ownership interest in its leased hospital business and disposed of certain real property assets as well.

Using public information related to that liquidation and the reported distribution of the proceeds from the liquidation, I have estimated the value of that liquidation to be in the range of $175M to $200M.

Because these assets were held "off-book" by the City, most of the liquidated proceeds are "invisible" in the official public accounting.

For example, millions of dollars of liquidated proceeds are being paid to the Healthy Lakewood Foundation from the liquidation of the hospital and those millions will never appear on the City's books.

This may be a good thing or it may be a bad thing, but whatever it is, it is not transparent to the citizenry.

-

Mark Kindt

- Posts: 2647

- Joined: Sat Dec 03, 2016 11:06 am

Re: City of Lakewood financials

There Are Invisible Liabilities Also

If you take the time to check all 5 pages of this 10-year financial summary, see if you can find the unfunded federal mandate for sewer/wastewater infrastructure upgrade.

The 2007 estimate was $274,000,000.

If you take the time to check all 5 pages of this 10-year financial summary, see if you can find the unfunded federal mandate for sewer/wastewater infrastructure upgrade.

The 2007 estimate was $274,000,000.

-

Richard Baker

- Posts: 367

- Joined: Mon Oct 10, 2005 12:06 am

Re: City of Lakewood financials

It does seem odd that the Mayor and Council tossing the hospital into the trash didn't have an effect on the city's income tax revenue string. Perhaps, like most of the City of Lakewood, the hospital and associated medical offices employees didn't live in Lakewood due to its's lack of commercial property, inept and inert city government, high property taxes and a mediocre school district. If that is the case, then the income tax contribution lost would have been .075 percent and not 1.5 percent but that still does not equate to new residents moving into the city, where, other than west end shipping container development what huge housing projects made space for new residents?

I agree with your comment that the city has a quarter of billion dollar mandate and it should be reflected in the city financials as a liability.. Perhaps the backroom Committee of the Whole think that it will go away and the city can continue to dump raw sewage into the river and lake. My question is, does the State of Ohio audit the City of Lakewood annual report? In Illinois an outside audit was required and the results were made public.

I agree with your comment that the city has a quarter of billion dollar mandate and it should be reflected in the city financials as a liability.. Perhaps the backroom Committee of the Whole think that it will go away and the city can continue to dump raw sewage into the river and lake. My question is, does the State of Ohio audit the City of Lakewood annual report? In Illinois an outside audit was required and the results were made public.

-

Mark Kindt

- Posts: 2647

- Joined: Sat Dec 03, 2016 11:06 am

Re: City of Lakewood financials

Mr. Baker, the closure of Lakewood Hospital reduced hospital-related lease revenues and hospital employee-related income tax revenues by an amount slightly over $2,000,000 annually.Richard Baker wrote:It does seem odd that the Mayor and Council tossing the hospital into the trash didn't have an effect on the city's income tax revenue string. Perhaps, like most of the City of Lakewood, the hospital and associated medical offices employees didn't live in Lakewood due to its's lack of commercial property, inept and inert city government, high property taxes and a mediocre school district. If that is the case, then the income tax contribution lost would have been .075 percent and not 1.5 percent but that still does not equate to new residents moving into the city, where, other than west end shipping container development what huge housing projects made space for new residents?

I agree with your comment that the city has a quarter of billion dollar mandate and it should be reflected in the city financials as a liability.. Perhaps the backroom Committee of the Whole think that it will go away and the city can continue to dump raw sewage into the river and lake. My question is, does the State of Ohio audit the City of Lakewood annual report? In Illinois an outside audit was required and the results were made public.

As I have noted above, I am convinced that certain "on-book" entries misreport values for liquidated "off-book" assets or related compensation without a proper adjustment for cost or basis, thus overstating the values.

Unfortunately, the Auditor of the State of Ohio, privatized much of its previous audit resources and that State Office has been totally unresponsive to numerous written citizen complaints.

- Jim O'Bryan

- Posts: 14196

- Joined: Thu Mar 10, 2005 10:12 pm

- Location: Lakewood

- Contact:

Re: City of Lakewood financials

Recently handed out a Lakewood Democratic Club meeting for Sam O'Leary and Jenn Pae to show everyone how good we are doing.

Welllllllll, I have always said when you need to hide bad financial news use pie charts and flow charts.

I am still trying to figure this Rube Goldberg drawing out but seems like Lakewood is down $10 million a year.

For those to young to remember...

A Rube Goldberg contraption.

.

Jim O'Bryan

Lakewood Resident

"The very act of observing disturbs the system."

Werner Heisenberg

"If anything I've said seems useful to you, I'm glad.

If not, don't worry. Just forget about it."

His Holiness The Dalai Lama

Lakewood Resident

"The very act of observing disturbs the system."

Werner Heisenberg

"If anything I've said seems useful to you, I'm glad.

If not, don't worry. Just forget about it."

His Holiness The Dalai Lama

-

Dan Alaimo

- Posts: 2140

- Joined: Fri Apr 23, 2010 8:49 am

Re: City of Lakewood financials

People at the meeting looked at this handout and wondered aloud: "what does this mean?"

“Never let a good crisis go to waste." - Winston Churchill (Quote later appropriated by Rahm Emanuel)

-

Bridget Conant

- Posts: 2896

- Joined: Wed Jul 26, 2006 4:22 pm

Re: City of Lakewood financials

That pie chart/arrow thing looks like a cartoon.

It’s called obsfucation.

It’s the one thing they ARE good at.

It’s called obsfucation.

It’s the one thing they ARE good at.

-

Dan Alaimo

- Posts: 2140

- Joined: Fri Apr 23, 2010 8:49 am

Re: City of Lakewood financials

Seriously. I was sitting next to someone who savvy about numbers and savvy about our City Hall. WTF?

“Never let a good crisis go to waste." - Winston Churchill (Quote later appropriated by Rahm Emanuel)

-

Kate McCarthy

- Posts: 481

- Joined: Mon Jun 20, 2005 1:25 pm

- Location: Lakewood

Re: City of Lakewood financials

Is it just me, or is "Other Major Special Revenue Funding Sources" an odd designation? And, is it also odd that in 2018 the most major, major special revenue funding source is the "Lakewood Hospital Fund (Cleveland Clinic Lease and EMS Billing)"? I've never understood where money came and went in this deal but I thought the lease payments ended when the master agreement was approved in 2015.

And there are no arrows associated with that box, does this mean those funds are set aside?

Call me completely confused.

And there are no arrows associated with that box, does this mean those funds are set aside?

Call me completely confused.

-

Mark Kindt

- Posts: 2647

- Joined: Sat Dec 03, 2016 11:06 am

Re: City of Lakewood financials

It is my understanding that the City of Lakewood had a separate hospital lease agreement for the period between the closure of the hospital and the opening of the family health center. Some lease revenues were received and reported during that interim period.Kate McCarthy wrote:Is it just me, or is "Other Major Special Revenue Funding Sources" an odd designation? And, is it also odd that in 2018 the most major, major special revenue funding source is the "Lakewood Hospital Fund (Cleveland Clinic Lease and EMS Billing)"? I've never understood where money came and went in this deal but I thought the lease payments ended when the master agreement was approved in 2015.

And there are no arrows associated with that box, does this mean those funds are set aside?

Call me completely confused.

-

Richard Baker

- Posts: 367

- Joined: Mon Oct 10, 2005 12:06 am

Re: City of Lakewood financials

[quote="Mark Kindt"][quote="Richard Baker"]

Unfortunately, the Auditor of the State of Ohio, privatized much of its previous audit resources and that State Office has been totally unresponsive to numerous written citizen complaints.[/quote]

It was the same in Illinois and the city paid for it. However, the auditor submitted his audit to the state and the city. Only a accounting firm with a death wish would not point out errors and emissions in the city books. The information that City of Lakewood being published is not, what the auditor reviewed as each fund has to be audited and checked for illegal fund transfers, etc. etc.

I suggest someone obtain the auditor's report in details, not the cover summary, for the last 10 years and start from there.

Unfortunately, the Auditor of the State of Ohio, privatized much of its previous audit resources and that State Office has been totally unresponsive to numerous written citizen complaints.[/quote]

It was the same in Illinois and the city paid for it. However, the auditor submitted his audit to the state and the city. Only a accounting firm with a death wish would not point out errors and emissions in the city books. The information that City of Lakewood being published is not, what the auditor reviewed as each fund has to be audited and checked for illegal fund transfers, etc. etc.

I suggest someone obtain the auditor's report in details, not the cover summary, for the last 10 years and start from there.