LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Moderator: Jim O'Bryan

-

David Anderson

- Posts: 400

- Joined: Mon Jun 05, 2006 12:41 pm

LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

All –

The cash to debt ratio covenant in the 1996 Definitive Agreement (section 2.1.1), which was in place prior to Council's action in December of 2015, indicated that the Clinic had no liability to cover operating losses or capital improvements over $500,000 unless hospital debt dramatically increased which could only be done so by the Lakewood Hospital Association with the permission of the Clinic (Section 1.1.1.6 of the previous definitive agreement).

This amounted to out/veto clause for the Clinic in the 1996 agreement. This clause shielded the Clinic from liability over $500,000. Why would the Clinic allow the Lakewood Hospital Association to go back into long-term debt to fund a capital improvement plan (the last of LHA’s notes were paid off in 2014) with only 11 or 12 years left on the lease?

The bottom line is that Council received excellent counsel from Thompson Hine and Huron Consulting. Council pushed every legal theory with TH and Huron to the nth degree over the course of many, many months. The issue of what entity was responsible for operating losses and capital expenses was among the first legal theories examined. The unequivocal conclusion: Lakewood Hospital Association would have to continue to fund operating losses as well as the up to $90M in capital improvements/maintenance needs (just a bit more than $500,000). All 2015 City Council members were 1,000% sure the Clinic and its legal team (Jones Day) came to the same determination long ago.

The documents referenced above can be found by going to onelakewood.com, clicking on "Healthcare in Lakewood" under Most Popular pages then on "Historical Documents" under More Information.

- 1996 Lakewood Hospital Definitive Agreement – Sections 1.1.1.6 (“Integration of Lakewood and the CCF Health System”) and 2.1.1 (“Covenants and Rights of CCF”).

- 1996 Lakewood Hospital Lease Agreement – Section 2.2 – "During the lease term, the Lessee (Lakewood Hospital Association) has sole and exclusive charge of the operation, maintenance, management, use, occupancy, and repair of the leased premises … "

See page 53 of the 89 page Huron Report (8/14/2015) which can be found at http://www.onelakewood.com/wp-content/u ... report.pdf

Yours in service,

David W. Anderson

Member of Council, Ward 1

david.anderson@lakewoodoh.net

216-789-6463

The cash to debt ratio covenant in the 1996 Definitive Agreement (section 2.1.1), which was in place prior to Council's action in December of 2015, indicated that the Clinic had no liability to cover operating losses or capital improvements over $500,000 unless hospital debt dramatically increased which could only be done so by the Lakewood Hospital Association with the permission of the Clinic (Section 1.1.1.6 of the previous definitive agreement).

This amounted to out/veto clause for the Clinic in the 1996 agreement. This clause shielded the Clinic from liability over $500,000. Why would the Clinic allow the Lakewood Hospital Association to go back into long-term debt to fund a capital improvement plan (the last of LHA’s notes were paid off in 2014) with only 11 or 12 years left on the lease?

The bottom line is that Council received excellent counsel from Thompson Hine and Huron Consulting. Council pushed every legal theory with TH and Huron to the nth degree over the course of many, many months. The issue of what entity was responsible for operating losses and capital expenses was among the first legal theories examined. The unequivocal conclusion: Lakewood Hospital Association would have to continue to fund operating losses as well as the up to $90M in capital improvements/maintenance needs (just a bit more than $500,000). All 2015 City Council members were 1,000% sure the Clinic and its legal team (Jones Day) came to the same determination long ago.

The documents referenced above can be found by going to onelakewood.com, clicking on "Healthcare in Lakewood" under Most Popular pages then on "Historical Documents" under More Information.

- 1996 Lakewood Hospital Definitive Agreement – Sections 1.1.1.6 (“Integration of Lakewood and the CCF Health System”) and 2.1.1 (“Covenants and Rights of CCF”).

- 1996 Lakewood Hospital Lease Agreement – Section 2.2 – "During the lease term, the Lessee (Lakewood Hospital Association) has sole and exclusive charge of the operation, maintenance, management, use, occupancy, and repair of the leased premises … "

See page 53 of the 89 page Huron Report (8/14/2015) which can be found at http://www.onelakewood.com/wp-content/u ... report.pdf

Yours in service,

David W. Anderson

Member of Council, Ward 1

david.anderson@lakewoodoh.net

216-789-6463

-

Brian Essi

- Posts: 2421

- Joined: Thu May 07, 2015 11:46 am

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Dear Councilman Anderson,

I am afraid that you continue to be misled and have been given a faulty interpretation of the agreement that even the CCF planners and attorneys know is false as can be plainly seen in there document below.

This should be no surprise to you---I wrote to you, Mayor Summers and the rest of City Council on April 13, 2015 the language of the Definitive Agreement is plain and clear:

CCF is essentially a Guarantor of the Lease and is required to finance LHA’s losses to provide all of the ‘Required Services” by operating Lakewood Hospital through 2026 even if losses are $214M NPV as Subsidium forecasted.

Section 2.1.1 of the DA provides in part, “CCF shall assure that Lakewood shall have a cash to debt ratio of 1:1 on a fiscal year basis…if it is determined that [LHA] does not meet such ratio, CCF shall advance sufficient funds to Lakewood to meet such ratio…any advances not repaid to CCF at such time as the [Lease] terminates shall be forgiven by CCF” In Section 1.8.1 of the DA, CCF agreed “Notwithstanding any provisions in this Agreement to the contrary, CCF acknowledges and agrees that no provisions in this Agreement will cause [LHA] to take action or omit to take any action that could cause [LHA] to fail to perform or observe, or otherwise be in default of, any of its obligations under the Lease...”

FYI A CCF attorney who was involved in the formation of the agreement and several independent legal experts have confirmed this conclusion.

Indeed, Madeline Cain's November, 1996 press release confirms the same conclusion saying the Lease and Definitive Agreement: “Provides City of Lakewood the right to require LHA to enforce provisions of the Agreement between LHA and CCF.”

The Huron Report is tainted and just parrots the secret information that CCF fed them--you should be made privy to Mr. Butler's admissions in responding my public records requests that the city was not privy to the information that CCF Fed Huron. Indeed, Butler is using Huron in litigation defending CCF. So Huron works for CCF and always has. Butler admitted this to me.

[/quote]

[/quote]

I am afraid that you continue to be misled and have been given a faulty interpretation of the agreement that even the CCF planners and attorneys know is false as can be plainly seen in there document below.

This should be no surprise to you---I wrote to you, Mayor Summers and the rest of City Council on April 13, 2015 the language of the Definitive Agreement is plain and clear:

CCF is essentially a Guarantor of the Lease and is required to finance LHA’s losses to provide all of the ‘Required Services” by operating Lakewood Hospital through 2026 even if losses are $214M NPV as Subsidium forecasted.

Section 2.1.1 of the DA provides in part, “CCF shall assure that Lakewood shall have a cash to debt ratio of 1:1 on a fiscal year basis…if it is determined that [LHA] does not meet such ratio, CCF shall advance sufficient funds to Lakewood to meet such ratio…any advances not repaid to CCF at such time as the [Lease] terminates shall be forgiven by CCF” In Section 1.8.1 of the DA, CCF agreed “Notwithstanding any provisions in this Agreement to the contrary, CCF acknowledges and agrees that no provisions in this Agreement will cause [LHA] to take action or omit to take any action that could cause [LHA] to fail to perform or observe, or otherwise be in default of, any of its obligations under the Lease...”

FYI A CCF attorney who was involved in the formation of the agreement and several independent legal experts have confirmed this conclusion.

Indeed, Madeline Cain's November, 1996 press release confirms the same conclusion saying the Lease and Definitive Agreement: “Provides City of Lakewood the right to require LHA to enforce provisions of the Agreement between LHA and CCF.”

The Huron Report is tainted and just parrots the secret information that CCF fed them--you should be made privy to Mr. Butler's admissions in responding my public records requests that the city was not privy to the information that CCF Fed Huron. Indeed, Butler is using Huron in litigation defending CCF. So Huron works for CCF and always has. Butler admitted this to me.

[/quote]

[/quote]David Anderson has no legitimate answers

-

David Anderson

- Posts: 400

- Joined: Mon Jun 05, 2006 12:41 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Mr. Essi, and all.

Section 1.1.1.6 is the trump card. “Lakewood’s incurrence, assumption or guarantee of any indebtedness, capital expenditures, or disposal of assets, in excess of $500,000 or such greater amount as the Member may from time to time specify in writing.” The sole "Member" is identified in Section 1.1 as "CCF."

The portion of Section 1.1.2 that you excluded from your reply reads “…that debt shall not include debt which has not been approved in accordance with and to the extent required by Section 1.1.1.6.”

Anyone can read the entire 1996 Definitive Agreement by going to onelakewood.com and clicking on Healthcare in Lakewood, then Historical Documents.

Your continued belief that Lakewood’s elected officials are immoral, unethical, acting illegally, undemocratically and, now, prone to being misled is not tethered to reality.

So, now your theory is that Kevin Butler has somehow summoned all the power of psychic ability to bring City Council, Huron Consulting leadership, the law firm of Thompson Hine, Judge Friedman, Judge O’Donnell, the 57% of voters who re-elected Mayor Summers under his control.

“Everyone who believes in telekinesis raise my hand.”

David W. Anderson

Member of Council, Ward One

216-789-6463

david.anderson@lakewoodoh.net

Section 1.1.1.6 is the trump card. “Lakewood’s incurrence, assumption or guarantee of any indebtedness, capital expenditures, or disposal of assets, in excess of $500,000 or such greater amount as the Member may from time to time specify in writing.” The sole "Member" is identified in Section 1.1 as "CCF."

The portion of Section 1.1.2 that you excluded from your reply reads “…that debt shall not include debt which has not been approved in accordance with and to the extent required by Section 1.1.1.6.”

Anyone can read the entire 1996 Definitive Agreement by going to onelakewood.com and clicking on Healthcare in Lakewood, then Historical Documents.

Your continued belief that Lakewood’s elected officials are immoral, unethical, acting illegally, undemocratically and, now, prone to being misled is not tethered to reality.

So, now your theory is that Kevin Butler has somehow summoned all the power of psychic ability to bring City Council, Huron Consulting leadership, the law firm of Thompson Hine, Judge Friedman, Judge O’Donnell, the 57% of voters who re-elected Mayor Summers under his control.

“Everyone who believes in telekinesis raise my hand.”

David W. Anderson

Member of Council, Ward One

216-789-6463

david.anderson@lakewoodoh.net

-

Brian Essi

- Posts: 2421

- Joined: Thu May 07, 2015 11:46 am

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Councilman Anderson,

I am sorry, but you have been misled again and that language you cite is superseded by other express language in the Definitive Agreement:

“1.1.4 All of the rights set forth in this Section 1.1 [that includes Section 1.1.1.6 you cite] shall be exercised by CCF in a fiscally prudent manner, consistent with Lakewood's charitable purpose and Lakewood's obligations under the lease, referred to in Section 1.8, below, in order to preserve the operations of Lakewood as a going concern, as defined under generally accepted accounting principles.”

And then, only two paragraphs below that section in the Definitive Agreement the language is as follows:

“SECTION 1.2 Rights of the City. The City shall have the rights set forth in the lease referred to in Section 1.8, below and annexed hereto as Exhibit 1.8 (the ''Lease”).”

So this clear language in the Definitive Agreement expressly overrides the 1.1.1.6 language that you cited above. This is straight forward contract interpretation that any seasoned contract attorney can understand.

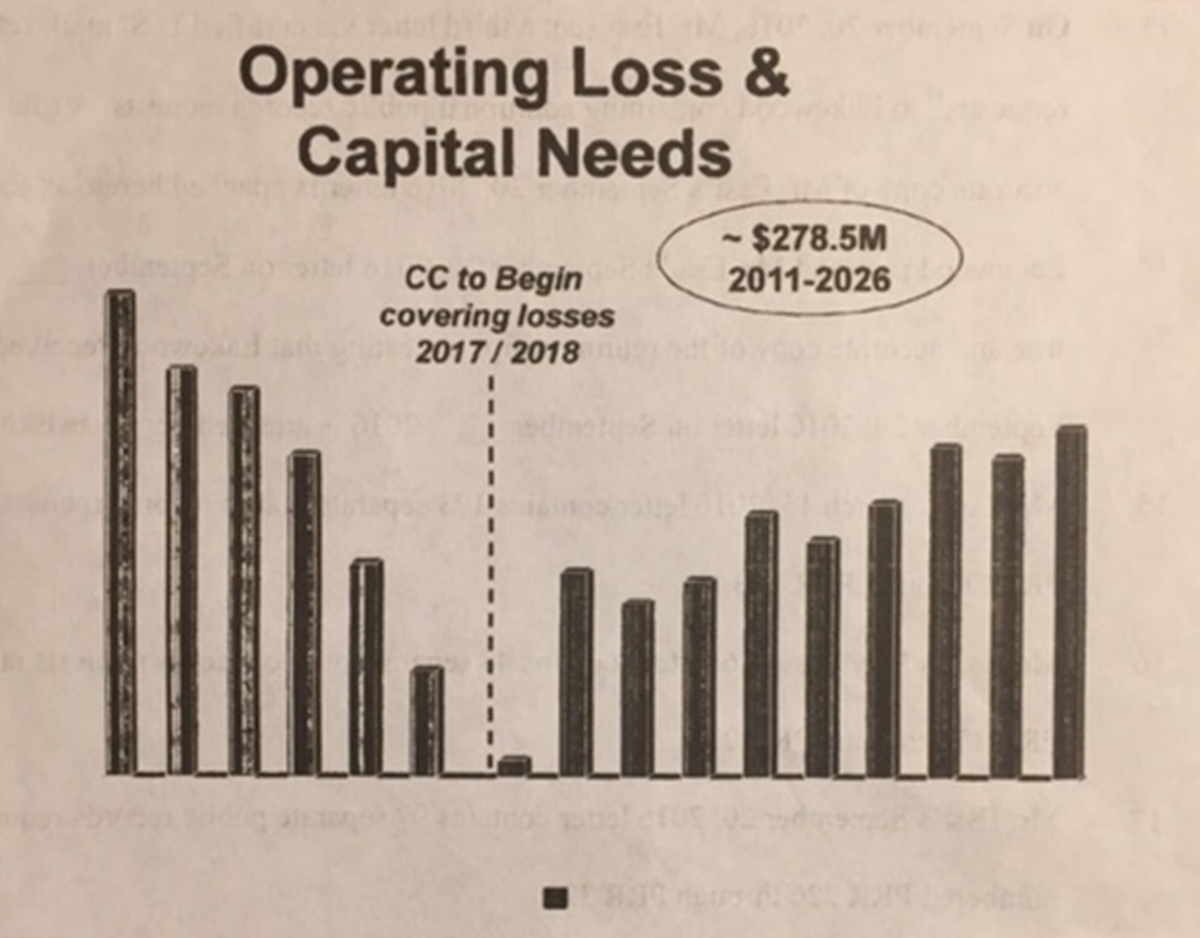

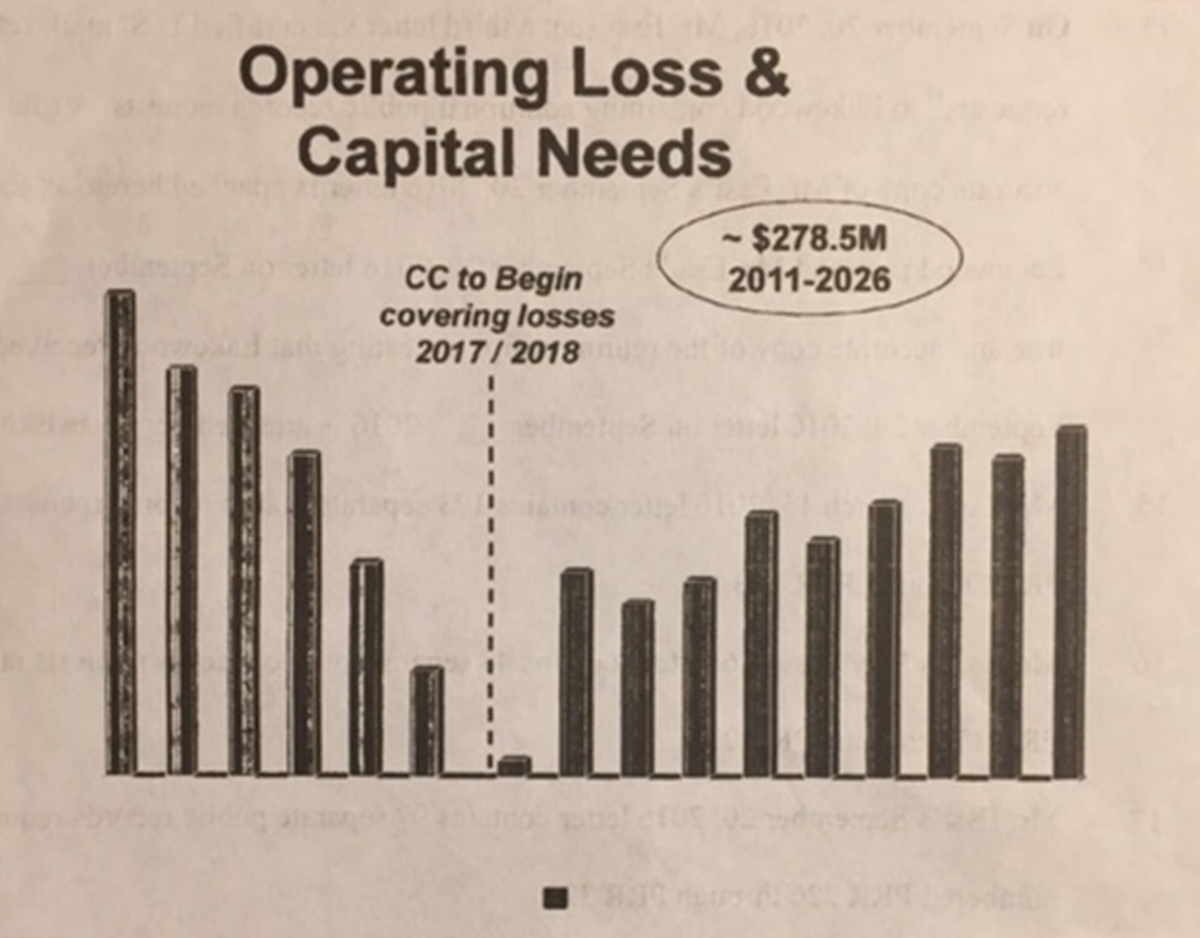

In layman’s terms, these two provisions in the Definitive Agreement expressly give the City the right to enforce provisions of the Lease and Definitive Agreement against CCF. Moreover, it is clear that CCF could not exercise any of CCF’s rights to limit LHA’s incurring of debt to make capital improvements over $500K if the failure to make those improvements threatened the mission of Lakewood Hospital, and LHA’s obligations under the Lease owed to the City. So if $90M of borrowing was needed to maintain the mission, CCF had to approve it--Indeed, CCF has admitted they had a $278M obligation to Lakewood.

Again, these facts should be no surprise to anyone---in November, 1996, then Mayor Madeline Cain described in a press release on the Definitive Agreement saying it:

“Provides City of Lakewood the right to require LHA to enforce provisions of the Agreement between LHA and CCF.”

Those express legal obligations and provisions were to operate a state of the art hospital for the residents of Lakewood including those who were unable to pay. By way of example only the Definitive Agreement provides at page 2:

“(ii) CCF will assure that Lakewood will have the authority to maintain and support the mission which currently defines the operations of Lakewood”

As the sole member of LHA, CCF also had the legal fiduciary duty to fulfill the mission of LHA as a matter of law. That meant it had to serve you, me, and the poor, not CCF and their rich executives' greed—and you admitted on December 21, 2015 in public that CCF did not do so. I will dig up the video of your statments later.

The documents disclosed in the lawsuit last week make it clear that CCF agrees with my interpretation and many other experts with whom I have conferred. The documents disclosed also further prove that CCF violated these express terms by running from Lakewood’s payer mix. i.e. the Lakewood mission of taking care of those who cannot afford to pay.

So CCF violated the letter and spirit of their agreement. Even Mayor Summers agreed to that fact in July 3, 2014 letter to Brian Donley.

I hope this puts to bed your mistaken understanding of the Definitive Agreement.

Whomever is advising you is cherry-picking provisions to give an illogical interpretation of the clear documents.

I am sorry, but you have been misled again and that language you cite is superseded by other express language in the Definitive Agreement:

“1.1.4 All of the rights set forth in this Section 1.1 [that includes Section 1.1.1.6 you cite] shall be exercised by CCF in a fiscally prudent manner, consistent with Lakewood's charitable purpose and Lakewood's obligations under the lease, referred to in Section 1.8, below, in order to preserve the operations of Lakewood as a going concern, as defined under generally accepted accounting principles.”

And then, only two paragraphs below that section in the Definitive Agreement the language is as follows:

“SECTION 1.2 Rights of the City. The City shall have the rights set forth in the lease referred to in Section 1.8, below and annexed hereto as Exhibit 1.8 (the ''Lease”).”

So this clear language in the Definitive Agreement expressly overrides the 1.1.1.6 language that you cited above. This is straight forward contract interpretation that any seasoned contract attorney can understand.

In layman’s terms, these two provisions in the Definitive Agreement expressly give the City the right to enforce provisions of the Lease and Definitive Agreement against CCF. Moreover, it is clear that CCF could not exercise any of CCF’s rights to limit LHA’s incurring of debt to make capital improvements over $500K if the failure to make those improvements threatened the mission of Lakewood Hospital, and LHA’s obligations under the Lease owed to the City. So if $90M of borrowing was needed to maintain the mission, CCF had to approve it--Indeed, CCF has admitted they had a $278M obligation to Lakewood.

Again, these facts should be no surprise to anyone---in November, 1996, then Mayor Madeline Cain described in a press release on the Definitive Agreement saying it:

“Provides City of Lakewood the right to require LHA to enforce provisions of the Agreement between LHA and CCF.”

Those express legal obligations and provisions were to operate a state of the art hospital for the residents of Lakewood including those who were unable to pay. By way of example only the Definitive Agreement provides at page 2:

“(ii) CCF will assure that Lakewood will have the authority to maintain and support the mission which currently defines the operations of Lakewood”

As the sole member of LHA, CCF also had the legal fiduciary duty to fulfill the mission of LHA as a matter of law. That meant it had to serve you, me, and the poor, not CCF and their rich executives' greed—and you admitted on December 21, 2015 in public that CCF did not do so. I will dig up the video of your statments later.

The documents disclosed in the lawsuit last week make it clear that CCF agrees with my interpretation and many other experts with whom I have conferred. The documents disclosed also further prove that CCF violated these express terms by running from Lakewood’s payer mix. i.e. the Lakewood mission of taking care of those who cannot afford to pay.

So CCF violated the letter and spirit of their agreement. Even Mayor Summers agreed to that fact in July 3, 2014 letter to Brian Donley.

I hope this puts to bed your mistaken understanding of the Definitive Agreement.

Whomever is advising you is cherry-picking provisions to give an illogical interpretation of the clear documents.

David Anderson has no legitimate answers

-

David Anderson

- Posts: 400

- Joined: Mon Jun 05, 2006 12:41 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

So, Brian, everyone is wrong but you - The law firm of Thompson Hine, Huron Consulting, the two attorneys serving on City Council, the law Director, the law firm of Jones Day.

Would you at least concede that there are mixed messages regarding these points in the 1996 DA and Lease? I read your comments as though you believe your interpretation of the 1996 DA is a slam dunk. Nothing could be further from the truth.

The LHA could exercise its rights to go into debt and did finance past debt based on anticipated future hospital revenue. The CCF had a clause not to be responsible for covering that debt over $500,000. The CCF helped refinance the last remaining $12M or so of hospital notes so that these remaining notes were paid off in 2014.

As you know, I personally asked CCF leaders during a public hearing as to whether the CCF and/or LHA had initiated any plans, draft or otherwise, for any potential Capital Improvements since 2010. The answer was "No."

Nobody has advised me on this issue since Thompson Hine and Huron Consulting did so for Council and the community in 2015 and it was comprehensive.

I am not saying that some LHA members and officials close to this issue from 2010 through 2014 weren't of the opinion that the CCF was responsible in these areas. The point is that, after a comprehensive analysis, it was determined by all parties that the CCF wasn't.

Would you at least concede that there are mixed messages regarding these points in the 1996 DA and Lease? I read your comments as though you believe your interpretation of the 1996 DA is a slam dunk. Nothing could be further from the truth.

The LHA could exercise its rights to go into debt and did finance past debt based on anticipated future hospital revenue. The CCF had a clause not to be responsible for covering that debt over $500,000. The CCF helped refinance the last remaining $12M or so of hospital notes so that these remaining notes were paid off in 2014.

As you know, I personally asked CCF leaders during a public hearing as to whether the CCF and/or LHA had initiated any plans, draft or otherwise, for any potential Capital Improvements since 2010. The answer was "No."

Nobody has advised me on this issue since Thompson Hine and Huron Consulting did so for Council and the community in 2015 and it was comprehensive.

I am not saying that some LHA members and officials close to this issue from 2010 through 2014 weren't of the opinion that the CCF was responsible in these areas. The point is that, after a comprehensive analysis, it was determined by all parties that the CCF wasn't.

-

Bridget Conant

- Posts: 2896

- Joined: Wed Jul 26, 2006 4:22 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

The point is that, after a comprehensive analysis, it was determined by all parties that the CCF wasn't.

CCF would certainly want to interpret the contract to THEIR advantage, and they have the money and high priced attorneys to argue their side.

It often appears that the city relied on advice from CCF or CCF connected principles. Is that in our best interest?

-

Brian Essi

- Posts: 2421

- Joined: Thu May 07, 2015 11:46 am

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Dear Councilman Anderson,David Anderson wrote:So, Brian, everyone is wrong but you - The law firm of Thompson Hine, Huron Consulting, the two attorneys serving on City Council, the law Director, the law firm of Jones Day.

Would you at least concede that there are mixed messages regarding these points in the 1996 DA and Lease? I read your comments as though you believe your interpretation of the 1996 DA is a slam dunk. Nothing could be further from the truth.

The LHA could exercise its rights to go into debt and did finance past debt based on anticipated future hospital revenue. The CCF had a clause not to be responsible for covering that debt over $500,000. The CCF helped refinance the last remaining $12M or so of hospital notes so that these remaining notes were paid off in 2014.

As you know, I personally asked CCF leaders during a public hearing as to whether the CCF and/or LHA had initiated any plans, draft or otherwise, for any potential Capital Improvements since 2010. The answer was "No."

Nobody has advised me on this issue since Thompson Hine and Huron Consulting did so for Council and the community in 2015 and it was comprehensive.

I am not saying that some LHA members and officials close to this issue from 2010 through 2014 weren't of the opinion that the CCF was responsible in these areas. The point is that, after a comprehensive analysis, it was determined by all parties that the CCF wasn't.

It is not a matter of me alone saying that City Hall is dead wrong. You (and City Hall) can’t even get around the clear contract terms I pointed out above that completely negate what you embraced as a “Trump” card. Moreover, CCF’s Dr. Bronson, Mayor Cain, CCF’s Fred DeGrandis writing to Mayor George (below), CCF’s attorney, the attorneys in the taxpayer lawsuit and many more are all saying the same thing as I am saying.

Please see the letter from CCF’s CEO of the CCHS Western Region, Fred DeGrandis (a CCF lawyer) from December 20, 2005 evidencing that CCF had obligation to the City of Lakewood with respect to capital improvements at Lakewood Hospital under the Definitive Agreement and Lease. Please note that the VP & General Counsel (a CCF lawyer) was copied on that letter and may even have helped DeGrandis draft it.

City Hall and you are in a bad spot because Mr. Butler made his “surrender” legal opinion public on the eve of “negotiating” with the Clinic last September. That’s why the deal was more than $10 million worse than the LOI

Here is my point by point response to your post:

1. Huron

As for your argument about Huron Consulting, you should be aware that Mr. Butler has admitted in response to public records requests: (1) that the city was not privy to information CCF fed Huron---so far Mr. Butler has refused to provide public records that were secretly provided to Huron; (2) Huron has been working on behalf of CCF and Toby Cosgrove in the litigation since the beginning of Huron’s engagement—Mr. Butler has refused to provide any of his communications with Huron claiming he can’t unless Toby Cosgrove and CCF allow him to release those records—those records are relevant to issue 64 and Huron’s conflict of interest; and (3) Mr. Butler has so far refused to produce any public records of communications between Huron and Thompson Hine.

2. Jones Day

Jones Day’s white collar crime lawyers are defending Toby Cosgrove and CCF in the taxpayer case involving fraud and implicating criminal behavior that was mention just last week in Court: “Evidence has been uncovered that suggests that officials of CCF may have made false and misleading statements relating to the promise of implementation of the Vision for Tomorrow Plan for Lakewood Hospital. Those misleading statements are evidence of a deception, in violation of Ohio Revised Code Section 2913.43 Securing Writings by Deception, as well as evidence of fraud as pled in Plaintiffs' complaint.” So I hope that City Council was not relying on Jones Day’s legal opinions. Mr. Butler has so far refused to produce any public records of communications between Jones Day and Thompson Hine.

3. O’Leary & Nowlin

Mr. O’Leary is probably a fine workers’ compensation and Mr. Nowlin is probably a fine domestic relations lawyer, but I hope are you not suggesting that you and others relied on a legal opinion from either of them in making a public decision of such importance? If so, was there any informed consent of their conflicts of interest?

4. Thompson Hine

Your reliance on Thompson Hine is most telling as they have never made any public statements on behalf of the city. Also, Mr. Butler is fighting several categories of public records requests concerning Thompson Hine’s activities on behalf of the city. It is clear, moreover, from the COW meeting recordings of April 6, 2015 (that you and I both attended) that Mayor Summers, Mr. Butler, Ms. Madigan and Ms. Pae all met privately with Thompson Hine before April 13, 2015 when you and the rest of City Council met with them. Mayors Summers had agreed to only speak favorably about the LOI and Madigan had already voted for it on LHA. So please explain why lawyers allegedly hired to conduct due diligence were meeting with the very people who had their minds made up and were full tilt publically supporting the plan before any due diligence was completed? Public records responses reveal that Thompson Hine did not disclose any conflicts of interest or obtain any informed consent prior to undertaking representation of all of City Council and the Administration.

How do you and City Hall reconcile the clear language in the agreement, Dr. Bronson’s admissions, DeGrandis’ admission or Mayor George and Mayor Cain unequivocal statements that are all 180 degrees from the conflicted group of advisers you relied upon?

If you have any public records, confidential or secret documents that counters the facts above or substantiate your claims, I suggest you speak with Mr. Butler and have him produce them.

The public and I are eager to have a look at them prior to voting on November 8th.

In the absence of such a production of records, may I suggest that the records being withheld are of such importance and do not support City Hall’s narrative, otherwise they would be public by now.

Sincerely,

Brian J. Essi

Lakewood Resident

David Anderson has no legitimate answers

-

David Anderson

- Posts: 400

- Joined: Mon Jun 05, 2006 12:41 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Ms. Conant -

I appreciate your point and it bears repeating that City Council took important steps to ensure that the law firm and industry consultant selected had no connection to CCF that would influence advice and opinion that would be given to City Council. I attended one "interview" with a local law firm in early 2015 and remember other members of Council participating in additional "interviews" with other firms. Huron Consulting interviewed in person as well as via phone if memory serves.

Thompson Hine and Huron Consulting developed answers and opinions to the question of what entity is responsible for operating losses and capital improvements as well as many other important topics many of which are outlined in the Huron Report.

http://www.onelakewood.com/wp-content/u ... report.pdf

City Council would certainly have taken steps in 2015 to push the Lakewood Hospital Association have the CCF pay close to the $90M needed in upgrades and repairs to make Lakewood Hospital safe and competitive if such steps were legitimate, binding options.

Regards,

David W. Anderson

Member of Council, Ward 1

216-789-6463

david.anderson@lakewoodoh.net

I appreciate your point and it bears repeating that City Council took important steps to ensure that the law firm and industry consultant selected had no connection to CCF that would influence advice and opinion that would be given to City Council. I attended one "interview" with a local law firm in early 2015 and remember other members of Council participating in additional "interviews" with other firms. Huron Consulting interviewed in person as well as via phone if memory serves.

Thompson Hine and Huron Consulting developed answers and opinions to the question of what entity is responsible for operating losses and capital improvements as well as many other important topics many of which are outlined in the Huron Report.

http://www.onelakewood.com/wp-content/u ... report.pdf

City Council would certainly have taken steps in 2015 to push the Lakewood Hospital Association have the CCF pay close to the $90M needed in upgrades and repairs to make Lakewood Hospital safe and competitive if such steps were legitimate, binding options.

Regards,

David W. Anderson

Member of Council, Ward 1

216-789-6463

david.anderson@lakewoodoh.net

-

Lori Allen _

- Posts: 2550

- Joined: Wed Jan 28, 2015 2:37 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Since the topic of Huron Consulting has surfaced, I would like to take this opportunity to inquire if anyone has seen or heard a statement from Ms. Marx regarding her apparent relationship with James W. Kemp Jr., Managing Director of Health and Education at Huron Consulting Group. According to Ms. Marx's 2013 pre-general campaign finance report, Ms. Marx received a contribution in the amount of $1,000 at a fundraiser on 9/1/13. Did Ms. Marx abstain from any voting or legislative action in regards to Huron Consulting?

Without thread-drifting too much, I would also like to briefly mention that Ms. Marx received campaign contributions from these individuals:

$100 from Dr. William J. Riebel, M.D. at a fundraiser on 8/27/13. Dr. Riebel was a Trustee for Lakewood Hospital Association (see Ms. Marx's 2013 pre-general campaign finance report at boe.cuyahogacounty.us)

$250 from Dr. Michael J. Mervart, M.D. on 7/1/13. Dr. Mervart is a Cleveland Clinic Neurological Surgeon (see Ms. Marx's 2013 pre-general campaign finance report at boe.cuyahogacounty.us)

A statement from Ms. Marx about the apparent relationship with Huron Consulting and regarding the contributions from Cleveland Clinic employees would be greatly beneficial in returning transparency to City Hall that has been lost.

I thought I would take this opportunity to mention this, since Huron Consulting was mentioned. Back on topic, carry on.

Without thread-drifting too much, I would also like to briefly mention that Ms. Marx received campaign contributions from these individuals:

$100 from Dr. William J. Riebel, M.D. at a fundraiser on 8/27/13. Dr. Riebel was a Trustee for Lakewood Hospital Association (see Ms. Marx's 2013 pre-general campaign finance report at boe.cuyahogacounty.us)

$250 from Dr. Michael J. Mervart, M.D. on 7/1/13. Dr. Mervart is a Cleveland Clinic Neurological Surgeon (see Ms. Marx's 2013 pre-general campaign finance report at boe.cuyahogacounty.us)

A statement from Ms. Marx about the apparent relationship with Huron Consulting and regarding the contributions from Cleveland Clinic employees would be greatly beneficial in returning transparency to City Hall that has been lost.

I thought I would take this opportunity to mention this, since Huron Consulting was mentioned. Back on topic, carry on.

-

David Anderson

- Posts: 400

- Joined: Mon Jun 05, 2006 12:41 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Mr. Essi -

The 2005 Dr. DeGrandis letter indicates that the CCF specified in writing prior to Dec. 12, 2005 that the CCF developed a plan with LHA for capital expenditures over a 10 year period in adherence to the terms and conditions of the agreement. Yes, if CCF authorized and agreed to a dramatic increase in hospital debt then, per the agreement, CCF is a liable partner. If LHA goes forward with any capital plan that dramatically increased debt without CCF’s approval, CCF is not liable over $500,000.

Without CCF’s prior approval, any action by LHA that dramatically increased hospital debt over $500,000 is the responsibility of the LHA. The letter and table you posted supports this point.

On another note, you mentioned "180 degrees." Well, the fourth dimension is time. Height, width, depth and time. Much time passed from 2005 to 2014. The Lakewood Hospital Association's consultant, Subsidium, reported that LHA would be out of resources before 2020. Huron said this date may be closer to 2022. Regardless, the lease was up in 2026 and there were no plans on the part of LHA or the Clinic to invest heavily in capital expenditures. You were in the room during the hearing when this point became crystal clear. I came to the determination that this hospital has been closing for the last 10 years and patient revenues were not covering operating costs let alone $90M in capital needs. There would have been nothing left in six years or less if we sat idly by and kicked the can down the road for the next Mayor or Council.

In regards to the Lakewood Hospital Association replacing the Clinic with another partner, Metro was not an option. Neither was United Hospitals. You and others are suggesting that another outside NE Ohio hospital operating entity would come into Lakewood, replace the Clinic at Lakewood Hospital as a new partner with LHA (with the Clinic's blessing), invest up to $90M in the physical plant and operations to make the Hospital safe and competitive all without access to referrals (patients), doctors or a network of partnering hospitals with which to work (second tier pricing).

Reasonable people can disagree and, honestly, I am a bit embarrassed at reading a couple of snarky comments I made toward you. (But, I'm only human and can only be called immoral, unethical, criminal, dumb, a money launderer, etc. without trying to exact a bit of revenge.) However, the bottom line is the bottom line. The business model by which this hospital was operating and the market in which it was operating was not allowing it to generate the patient income needed to run the hospital. The Clinic was not obligated to subsidize these losses or capital needs to any real extent.

We replaced the convoluted City, LHA, Clinic relationship (which, to Mayor Cain's credit, served Lakewood well for 18 years) with a partnership by which the Clinic invests its own $49M, accounts for the disposition of $128M of taxpayer assets, brings 21st Century health care to Lakewood along with a fully accredited, fully functioning 24/7 Emergency Room operated by a globally recognized preeminent health care provider. It also guarantees that the 24/7 Emergency Room remain fully functioning for as long as the Clinic operates the Family Health Center. If the Clinic decides not to operate the FHC in the future, the City has first rights to the state of the art FHC and ER facility and would be in strong position to find a new partner. However, I do not see that scenario coming to fruition at all as I believe the Clinic as committed to Lakewood for the long term. Finally, there is more than enough bridge funding to see the City to the development of 5.7 acres in the middle of our our city and the return of this 5.7 acres to tax generating, school supporting, economy reinforcing status.

David W. Anderson

Member of Council, Ward One

216-789-6463

davidwanderson@lakewoodoh.net

The 2005 Dr. DeGrandis letter indicates that the CCF specified in writing prior to Dec. 12, 2005 that the CCF developed a plan with LHA for capital expenditures over a 10 year period in adherence to the terms and conditions of the agreement. Yes, if CCF authorized and agreed to a dramatic increase in hospital debt then, per the agreement, CCF is a liable partner. If LHA goes forward with any capital plan that dramatically increased debt without CCF’s approval, CCF is not liable over $500,000.

Without CCF’s prior approval, any action by LHA that dramatically increased hospital debt over $500,000 is the responsibility of the LHA. The letter and table you posted supports this point.

On another note, you mentioned "180 degrees." Well, the fourth dimension is time. Height, width, depth and time. Much time passed from 2005 to 2014. The Lakewood Hospital Association's consultant, Subsidium, reported that LHA would be out of resources before 2020. Huron said this date may be closer to 2022. Regardless, the lease was up in 2026 and there were no plans on the part of LHA or the Clinic to invest heavily in capital expenditures. You were in the room during the hearing when this point became crystal clear. I came to the determination that this hospital has been closing for the last 10 years and patient revenues were not covering operating costs let alone $90M in capital needs. There would have been nothing left in six years or less if we sat idly by and kicked the can down the road for the next Mayor or Council.

In regards to the Lakewood Hospital Association replacing the Clinic with another partner, Metro was not an option. Neither was United Hospitals. You and others are suggesting that another outside NE Ohio hospital operating entity would come into Lakewood, replace the Clinic at Lakewood Hospital as a new partner with LHA (with the Clinic's blessing), invest up to $90M in the physical plant and operations to make the Hospital safe and competitive all without access to referrals (patients), doctors or a network of partnering hospitals with which to work (second tier pricing).

Reasonable people can disagree and, honestly, I am a bit embarrassed at reading a couple of snarky comments I made toward you. (But, I'm only human and can only be called immoral, unethical, criminal, dumb, a money launderer, etc. without trying to exact a bit of revenge.) However, the bottom line is the bottom line. The business model by which this hospital was operating and the market in which it was operating was not allowing it to generate the patient income needed to run the hospital. The Clinic was not obligated to subsidize these losses or capital needs to any real extent.

We replaced the convoluted City, LHA, Clinic relationship (which, to Mayor Cain's credit, served Lakewood well for 18 years) with a partnership by which the Clinic invests its own $49M, accounts for the disposition of $128M of taxpayer assets, brings 21st Century health care to Lakewood along with a fully accredited, fully functioning 24/7 Emergency Room operated by a globally recognized preeminent health care provider. It also guarantees that the 24/7 Emergency Room remain fully functioning for as long as the Clinic operates the Family Health Center. If the Clinic decides not to operate the FHC in the future, the City has first rights to the state of the art FHC and ER facility and would be in strong position to find a new partner. However, I do not see that scenario coming to fruition at all as I believe the Clinic as committed to Lakewood for the long term. Finally, there is more than enough bridge funding to see the City to the development of 5.7 acres in the middle of our our city and the return of this 5.7 acres to tax generating, school supporting, economy reinforcing status.

David W. Anderson

Member of Council, Ward One

216-789-6463

davidwanderson@lakewoodoh.net

-

Michael Deneen

- Posts: 2133

- Joined: Fri Jul 08, 2005 4:10 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Mr. Anderson: I left a couple questions for you on the "Cindy Marx Endorses Dem Club Leadership" thread.

A response would be appreciated.

A response would be appreciated.

-

Brian Essi

- Posts: 2421

- Joined: Thu May 07, 2015 11:46 am

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Dear Councilman Anderson,David Anderson wrote:Mr. Essi -

The 2005 Dr. DeGrandis letter indicates that the CCF specified in writing prior to Dec. 12, 2005 that the CCF developed a plan with LHA for capital expenditures over a 10 year period in adherence to the terms and conditions of the agreement. Yes, if CCF authorized and agreed to a dramatic increase in hospital debt then, per the agreement, CCF is a liable partner. If LHA goes forward with any capital plan that dramatically increased debt without CCF’s approval, CCF is not liable over $500,000.

Without CCF’s prior approval, any action by LHA that dramatically increased hospital debt over $500,000 is the responsibility of the LHA. The letter and table you posted supports this point.

On another note, you mentioned "180 degrees." Well, the fourth dimension is time. Height, width, depth and time. Much time passed from 2005 to 2014. The Lakewood Hospital Association's consultant, Subsidium, reported that LHA would be out of resources before 2020. Huron said this date may be closer to 2022. Regardless, the lease was up in 2026 and there were no plans on the part of LHA or the Clinic to invest heavily in capital expenditures. You were in the room during the hearing when this point became crystal clear. I came to the determination that this hospital has been closing for the last 10 years and patient revenues were not covering operating costs let alone $90M in capital needs. There would have been nothing left in six years or less if we sat idly by and kicked the can down the road for the next Mayor or Council.

In regards to the Lakewood Hospital Association replacing the Clinic with another partner, Metro was not an option. Neither was United Hospitals. You and others are suggesting that another outside NE Ohio hospital operating entity would come into Lakewood, replace the Clinic at Lakewood Hospital as a new partner with LHA (with the Clinic's blessing), invest up to $90M in the physical plant and operations to make the Hospital safe and competitive all without access to referrals (patients), doctors or a network of partnering hospitals with which to work (second tier pricing).

Reasonable people can disagree and, honestly, I am a bit embarrassed at reading a couple of snarky comments I made toward you. (But, I'm only human and can only be called immoral, unethical, criminal, dumb, a money launderer, etc. without trying to exact a bit of revenge.) However, the bottom line is the bottom line. The business model by which this hospital was operating and the market in which it was operating was not allowing it to generate the patient income needed to run the hospital. The Clinic was not obligated to subsidize these losses or capital needs to any real extent.

We replaced the convoluted City, LHA, Clinic relationship (which, to Mayor Cain's credit, served Lakewood well for 18 years) with a partnership by which the Clinic invests its own $49M, accounts for the disposition of $128M of taxpayer assets, brings 21st Century health care to Lakewood along with a fully accredited, fully functioning 24/7 Emergency Room operated by a globally recognized preeminent health care provider. It also guarantees that the 24/7 Emergency Room remain fully functioning for as long as the Clinic operates the Family Health Center. If the Clinic decides not to operate the FHC in the future, the City has first rights to the state of the art FHC and ER facility and would be in strong position to find a new partner. However, I do not see that scenario coming to fruition at all as I believe the Clinic as committed to Lakewood for the long term. Finally, there is more than enough bridge funding to see the City to the development of 5.7 acres in the middle of our our city and the return of this 5.7 acres to tax generating, school supporting, economy reinforcing status.

David W. Anderson

Member of Council, Ward One

216-789-6463

davidwanderson@lakewoodoh.net

Thank you again for your response and willingness to post here on the Deck.

You and Councilman Dan O'Malley are the only two public officials that have the courage to do so.

May I further suggest that the reason you are speaking out is that heretofore you have enjoyed more credibility than any other elected officials who voted for this plainly bad deal and the rest are happy to have you squander your political capital while they hide.

Having said that, I must add that your credibility as a reasonable person does not extend to you having great expertise on the complexity of the financial, legal, healthcare, contractual nuances, etc. That is not to say that I believe you to be "immoral, unethical, criminal, dumb, a money launderer" and the other things you seem to attribute to me, but that I never said--to the extent my writings came across that way, please accept my apologies.

Also, please recall, when I first wrote you and your council members back on April 13, 2015 (JOB posted it on the Deck before I knew what the Deck was) I wrote: "To add to this drama you are asked to become instant experts not only on Lakewood Hospital’s past, present and future, but also on the complexity and nuances of the current and future needs of Lakewood, the existing legal documents and all the while being denied information from the folks pushing for a decision that might be critical for you to make your decision." That was an unreasonable expectation by Summers and CCF who sprung this on you at the last minute--- as your recent writings have proven your limitations on the analysis. My sincere hope is that the credibility and political capital you once had enjoyed is not squandered at the hands of the others who have misled you.

Moreover, I note that you have avoided addressing many of the specifics facts and questions that I have raised above and below that establish that the heading of this thread simply not true.

Among the most undeniable and unassailable facts that negate what you wrote are:

There was never a valuation, marketing or bidding of any hospital assets so City Hall has no idea what the true value was.

The Master Agreement Costs Taxpayer nearly $400M because CCF Pays $9.6M for108M worth of Hospital value, and escapes an admitted $278M required investment in Lakewood.

• The Cleveland Clinic Foundation admits liability to Lakewood of $278 million.

• Clinic records show Clinic will make $11.5 million additional profit each year into the future due to the hospital closure.

• State Auditor Report shows the Clinic paid only $9.6 million in the purchase of Lakewood Hospital

• In exchange for only $9.6 million, the Clinic received $108 million or 60% of $180 million fair market value of Lakewood Hospital.

Clinic records prove the Clinic was Liable for $278 million prior to the Master Agreement

Secret internal planning documents prepared by the Clinic and filed in Court in the pending taxpayer lawsuit on October 5, 2016, prove that the Clinic was liable for required capital improvements and all losses at Lakewood Hospital through 2026. The Clinic’s own documents from 2011 declare the amount of the Clinic’s liability was $278 million beginning in 2017 which would have made Lakewood Hospital a state of the art hospital on par with the Clinic’s other hospitals.

This is at odds with Lakewood Law Director Kevin Butler’s September, 2015 legal opinion in which he claimed: “The Cleveland Clinic is not required to cover LHA’s operating losses. And neither LHA nor the Cleveland Clinic is obligated to invest significant capital money into the hospital facility-making major improvements at the hospital the city’s responsibility.” Butler’s legal opinion was the most important reason cited by City Council when they authorized Butler to negotiate the Master Agreement.

The Clinic will make over $11.5 million per year into the future from the Master Agreement

Other internal planning documents from 2011 just filed in Court, show that the Clinic planners “calculated the closing of Lakewood Hospital would result in a $11.5 million a year windfall” profit to the Clinic’s other hospitals because “CCF hospitals would capture an additional 5,000 inpatient visits per year with a closed Lakewood Hospital.” The documents show that as far back as 2011, the Clinic wanted to avoid its $278 million obligation by closing the hospital and harvesting the “premium payer mix” of Lakewood patients using the proposed family health center (FHC) to refer patients to the Clinic’s other hospitals.

On January 14, 2015, CCF’s Brian Donley (second in charge to Toby Cosgrove) referred to the FHC as a “specialty referral center.” Lakewood’s low-pay and self-pay patients would be referred out of Lakewood to Metro Hospital and other non-Clinic hospitals. The Master Agreement gives the Clinic a non-compete, or restrictive covenant (terms are interchangeable), that prohibits its competitors from operating at the former Lakewood Hospital site and assures the Clinic’s dominance in Lakewood as a “referral center.” The non-compete also guarantees that the land will be available to developers—which the court documents and sworn testimony reflect Summers and the Clinic planned since 2011, and earlier.

The State Auditor Report shows the Clinic paid only $9.6 million in the hospital “sale”

Public records released by Finance Director Jenn Pae on September 29, 2016 to support the City of Lakewood Comprehensive Annual Financial Review (CAFR), clearly demonstrate that the Cleveland Clinic paid only $9.6M to the city to purchase 60% of Lakewood Hospital’s $180 million FMV. The CAFR was prepared by the State Auditor’s office so the $9.6 million number is not subject to debate.

According to the CAFR, which was prepared with the participation of Mayor Summers and his administration: The Master Agreement disposed of "The City-owned Lakewood Hospital" (CAFR, page 47) in a “sale of Lakewood Hospital to the Cleveland Clinic” (CAFR, pages 42 and 44). The full CAFR can be found at https://ohioauditor.gov/auditsearch/Rep ... yahoga.pdf

In his January, 2016 deposition in the taxpayer lawsuit, when Summers (a defendant) was asked why there were no appraisals of hospital assets and why an investment banker was not hired to market the hospital, he testified: "We weren't selling this hospital.” [Summers transcript page 155; line 14.]

In the last issue of the Lakewood Observer, Councilman David Anderson wrote: “...the Lakewood Hospital Association’s net assets were valued at $128 million. The negotiated deal accounts for all of the $128 million.” However, it has been previously established through public records requests that neither the Mayor nor City Council conducted any appraisal of the hospital assets and Mr. Anderson’s $128 million number is the net “book value” of the assets and not a fair market value of the assets.

The Fair Market Value of Lakewood Hospital was $180 million

Nevertheless, now that it has been established that a “sale of Lakewood Hospital to the Clinic” took place, and that the Clinic paid only $9.6 million, the question remains:

What was the value of hospital assets sold to the Clinic for the $9.6 million the Clinic paid?

Investment bankers and hospital valuation experts generally agree that that the fair market value (FMV) for the sale of a hospital, is about 75% of annual “net revenues.” The logic behind this valuation approach is that the purchaser is paying for the revenue stream from existing patient lists as part of a going concern. Using this valuation method would produce a $180 million FMV when Lakewood’s $87 million liquid investment portfolio is included. This valuation is supported by the reported by the comparable sale price of St. John’s Hospital in Westlake to University Hospitals in 2015.

The Clinic Received $108 million of the Hospital FMV paying only $9.6 million

The Master Agreement terms and the CAFR together establish that the Clinic received $108 million of hospital FMV in exchange for $9.6 million:

1. $63.4 million—Net Value of the Non-Compete/Restrictive, together with all patient records and patient information, equipment, furniture, fixtures, bed licenses and tangible and intangible property.

2. $30 million--cash portion of the hospitals liquid investments.

3. $1.6 million--value of 1.8 Acres of cleared land on Belle and Detroit.

4. $13 million--FMV of Columbia Road surgical centr.

Total Cash, Property and Rights to Clinic: $108 million

Summary of how $180 million hospital value was distributed/sold

So here is the summary of what each party gets from the $180 million city-owned hospital:

1. $22 million returned to the City (12 %)

2. $16.5 million (net present value) to new foundation (9%).

3. $33.5 million released to Lakewood Hospital Foundation for private charitable use. (19%)

4. $108 million to the Clinic. (60%)

Total: $180 million

Issue 64 on November 8th gives voters the chance to vote for or against the Master Agreement.

Lakewood Voters must judge whether the Master Agreement is a good or bad financial deal for Lakewood; and a good or bad deal for their future healthcare.

The following details and analysis support whet I wrote above. It is intended to serve as a guide to simplify the overly complex terms of the Master Agreement that have been mischaracterized and misunderstood by various elected and public officials and others.

I. The 2015 CAFR (and the recently release records) show the city received $9.6 million from CCF for Lakewood Hospital, which includes:

1. $ 6,644,731 sale proceeds Columbia Road property (Per CAFR).

2. $1,400,00 promissory note from CCF for sale of Columbia Road (Per CAFR)

3. $1,576,000 for sale of Detroit/Belle land sold to CCF (Per CAFR).

Total Received from CCF: $9,620,731.

II. The Clinic gets $108 of the $180M FMV of the Hospital (60%).

The Master Agreement read together with the CAFR provides that the Clinic received $108 million of hospital fair market value (FMV) in exchange for $9.6 million. This includes:

5. $63.4 million—Net Value of the non-compete/restrictive covenant blocking all of its competitors from operating at the former hospital site, together with all patient records and patient information as well as a covenant together with equipment, furniture, fixtures bed licenses and tangible and intangible property.

6. $30 million — cash portion of the hospitals liquid investments (see below).

7. $1.6 million — value of 1.8 acres of cleared land on west side of Belle and Detroit.

8. $13 million — FMV of Columbia Road surgical center (CCF only paid $8M)

III. Overview of what each party gets from $180M FMV of Lakewood Hospital.

So here is the overview of what each party get from the $180M FMV of the city-owned hospital:

5. $7M Demolition payments to City.

6. $5.4M surrender of control of real estate owned by the City.

7. $9.6M for Columbia Road and Belle/Detroit Land paid to City (per CAFR).

8. $16.5M Net Present Value of payments to a new foundation, largely controlled by CCF.

9. $33.5M returned to Lakewood Hospital Foundation for private use.

10. $108 M — FMV of all assets transferred to CCF for $9.6M payment to city.

IV. According to the CAFR and the Master Agreement the City will receive only $22 million value for the hospital closing.

1. $8M sale proceeds Columbia Road property (per CAFR).

2 $7M as demolition payment toward tear down of hospital (from Master Agreement).

3. $1.6M for FHC Site land sold to CCF (Per CAFR).

6. $1M for seven residential properties (per CAFR).

7. $0.7M for existing community health center (per CAFR).

8. $3.7M estimated value of hospital site, subject to non-compete and CCF parking lot rights not returned to city until 2018.

Total to be received by City: $22M.

V. Lakewood Hospital had a fair market value of $180M:

1. Industry standards used by Investment Bankers:75% of 2014 net revenues of $124 million equals $93 million, plus investment portfolio of $87 million puts FMV of Lakewood Hospital at $180M.

2. Supporting the $93 million FMV is the 2015 announcement that University Hospitals (UH) had paid $90M for the smaller St. John’s Hospital in Westlake. UH received no liquid investments in that sale.

3. The Clinic will make $11.2 million profit per year—capitalized this supports the $93M valuation.

4. Subsidium — a conflicted expert hired by CCF placed an average FMV $71M Lakewood Hospital plus $87 million investments. $158M FMV.

VI. CCF receives $30M of LHA’s liquid assets.

1. $2.5M paid to CCF’s Cayman Islands insurance company to protect CCF.

2. $2.5 M paid to CCF to help CCF build parking lot owned by CCF.

3. $3.5 M to CCF for demolition of parking garage and medical building on CCF land.

4. $21.5 M to CCF as cash “dissolution distribution.”

Please Note CCF receives the direct benefit of $30M of cash and an indirect benefit of $16.5M by controlling the new foundation. Total cash assets benefiting CCF=$43.1

City receives only $7M from LHA liquid assets.

VII. Distributions from Hospital’s $87 M in Liquid Assets

1. $7M demolition payments to City.

2. $16.5M Net Present Value of payments to the new foundation, largely controlled by CCF.

3. $33.5M returned to Lakewood Hospital Foundation for private use.

4. $30M balance to CCF[/quote]

David Anderson has no legitimate answers

-

David Anderson

- Posts: 400

- Joined: Mon Jun 05, 2006 12:41 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

You’re right, Brian, I am not a lawyer. But, while you discount my MBA, Master’s in Education, overall experience and, at least, a modicum of executive functioning (though my kids would certainly disagree), you seem to not be aware that the 2015 CAFR, which you site as a base for a flurry of claims, only recorded the cash transactions that occurred on or prior to December 31, 2015. Lakewood did not take back the properties (back on the City’s books from when these went off in 1987) until early 2016. Thus, the asset value for these properties will not be reported on Lakewood’s financials until the 2016 CAFR is released in 2017. Would this not qualify as an overlook on your part of a not so complex nuance? (Sorry, man, I couldn't resist.)

There is a breakdown of “actual and projected revenues to the City” which I can't find a way to attach. I spoke with Director Pae two days ago about how I would appreciate such an updated table. She already had it and forwarded it to me at 3:42 p.m. before our conversation had even ended.

CCF Contracted revenues and projected other associated revenues per year (not including the $32.4M for the new Lakewood Foundation):

2015 - $8.7M

2016 - $4.8M

2017 - $1.7M

2018 - $9.1M

2019 through 2026 - $5.1M ($588,770 to $699,976 per year)

There is a breakdown of “actual and projected revenues to the City” which I can't find a way to attach. I spoke with Director Pae two days ago about how I would appreciate such an updated table. She already had it and forwarded it to me at 3:42 p.m. before our conversation had even ended.

CCF Contracted revenues and projected other associated revenues per year (not including the $32.4M for the new Lakewood Foundation):

2015 - $8.7M

2016 - $4.8M

2017 - $1.7M

2018 - $9.1M

2019 through 2026 - $5.1M ($588,770 to $699,976 per year)

-

Bridget Conant

- Posts: 2896

- Joined: Wed Jul 26, 2006 4:22 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Why do you think the city would be able to find a new health care entity to provide services at some point in the future when you couldn't, or wouldn't, find one now?If the Clinic decides not to operate the FHC in the future, the City has first rights to the state of the art FHC and ER facility and would be in strong position to find a new partner.

-

Michael Deneen

- Posts: 2133

- Joined: Fri Jul 08, 2005 4:10 pm

Re: LHA, not the Clinic, responsible for capital improvements and operating losses - READ the 1996 AGREEMENT

Bingo!Bridget Conant wrote:Why do you think the city would be able to find a new health care entity to provide services at some point in the future when you couldn't, or wouldn't, find one now?

As the old saying goes, "Fool me once, shame on you. Fool me twice, shame on me."