Asst Sec. of the Treasury In Lakewood To Discuss Foreclosure

Posted: Mon May 03, 2010 12:59 pm

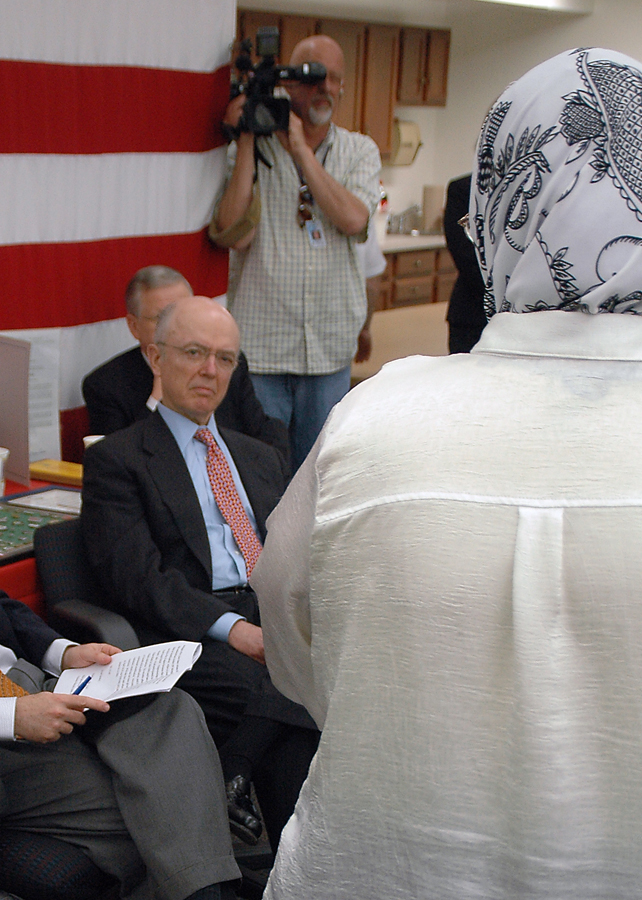

Congressman Kucinich, Assistant Secretary of the Treasury for Financial Stability of the United States, listens to Jay Messner speak about his various nightmares dealing with loan reduction, HUD, and other things that hindered his progress.

Mr. Messner was talking about how he had to stand in line for 12 hours just to get forms,

that he had to send in 4 different times because they were lost. Including almost 10 hours

on the phone, including one time for five hours just to get his application filed with Chase

Bank. Who then lost it 3 more times.

He was then taken to Columbus to sit next to Chase Execs and Governor Stricklin as a

model of how good the program is. At that meeting he was assured that he was approved

and his reduction of $197 would be reflected in his next bill, due in September. That August

he was foreclosed, and asked to leave his home by Chase which claimed zero knowledge

of him being approved for anything. Even after they located documents from his day

on stage they continued to pile on late fees and surcharges of more than $6,000 in

6 weeks, and was about to loose everything when Congressman Kucinich stepped in.

Sec. Alisson promised they would look into the loan!

The congressman stated that 90% of the homeowners in Cuyahoga County would be

eligible for loan and payment reduction. Sec. Alisson stated the average for home reduction

was $500 nationwide, and stated "Keep fighting, and try and try again." Most there

thought there had to be a better way.

One issue that was brought up, and I was told they would look into was the possible

conflict of interest by people with housing programs, that also have the ability to buy

foreclosed homes, and then resell or landbank them for development. The Secretary

was outraged to think that HUD programs would be used to gentrify neighborhoods

instead of serving the community residents that were counting on them, and promised

to look into any such thing that was brought to his attention.

In attendance were many councilman from Cleveland and surrounding suburbs, and many

mayors and civic leaders of various programs dedicated to help homeowners through this

crisis. All were thanked for their dedication to doing the right thing, and were asked to

blow whistles on those doing the wrong things such as described above, asking for any

form of payment for loan reduction of consultation. The secretary underlined that the Feds

should be notified immediately of any problems or need for oversight, and that help could

be found by going through http://makinghomeaffordable.gov.

Lakewood had no one there from city hall or any civic programs in attendance.

.