David Anderson wrote:Mr. Essi's article entitled, "State Auditor Report Confirms Cleveland Clinic Paid $9.6 Million, A Fraction of Hospital Value, For Lakewood Hospital" is blatantly false and we should all demand an immediate apology and retraction.

First off, the City of Lakewood did not sell the hospital. The City still owns the hospital and the land under it and will continue to do so until the moment before it is developed via a market driven transaction.

Secondly, the 2015 CAFR, which is sited by Mr. Essi as a base for his false headline, only recorded the cash transactions that occurred on or prior to December 31, 2015. Lakewood did not take back the properties (back on the City’s books from when these went off in 1987) until early 2016. Thus, the asset value for these properties will not be reported on Lakewood’s financials until the 2016 CAFR is released in 2017.

There is a breakdown of “actual and projected revenues to the City” which I am having difficulty attaching. I spoke with Finance Director Jennifer Pae two days ago about how I would appreciate such an updated table. She already had it and forwarded it to me at 3:42 p.m. before our conversation had even ended.

Clinic contracted revenues and projected other associated revenues per year (not including the $32.4M for the new Lakewood Health Foundation). Most of the amounts below are in the form of the annual lease payment, hospital rehab/demo, net proceeds from the sale of 850 Columbia Road complex and proceeds from the sale of the Medical Office Building and the parking garage. The 2016 figure includes $900,000 for the projected sale of long time city owned but Lakewood Hospital Association managed homes on Belle and St. Charles.

2015 - $8.7M

2016 - $4.8M

2017 - $1.7M

2018 - $9.1M

2019 through 2026 - $5.1M ($588,770 to $699,976 per year)

Thank you, in advance, for the retraction and apology, Mr. Essi.

David W. Anderson

Member of Council, Ward One

216-789-6463

david.anderson@lakewoodoh.net

Councilman Anderson,

I'm sorry, but you are mistaken once again and it is you that now owes me an apology.

Throwing numbers around without supporting documents does not make the numbers facts--let's play fair--all of my numbers are grounded to the LHA or city financial statements or specific provisions of the Master Agreement.

According to the CAFR, which was prepared with the participation of Mayor Summers and his administration including Jenn Pae: The Master Agreement disposed of "The City-owned Lakewood Hospital" (CAFR, page 47) in a “sale of Lakewood Hospital to the Cleveland Clinic” (CAFR, pages 42 and 44). The full CAFR can be found at

https://ohioauditor.gov/auditsearch/Rep ... yahoga.pdf Jenn Pae, Mike Summers and the State Auditors have characterized the hospital as having been sold--I am just quoting the CAFR so if it was not sold, your beef is with Summers, et al.

The net proceeds from the sale of 850 Columbia Road complex and proceeds from the sale of the Medical Office Building and the parking garage were both included and reported in the 2015 CAFR as follows:

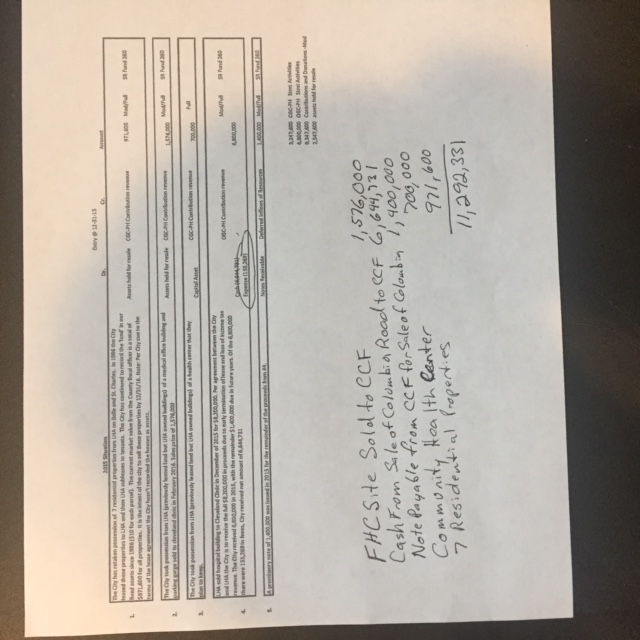

I. The 2015 CAFR (and the recently release records below) show the city received $9.6 million from CCF for Lakewood Hospital, which includes:

1. $ 6,644,731 sale proceeds Columbia Road property (Per CAFR).

2. $1,400,00 promissory note from CCF for sale of Columbia Road (Per CAFR)

3. $1,576,000 for sale of Detroit/Belle land sold to CCF (Per CAFR).

Total Received from CCF: $9,620,731.

This $9.6M is documented in a portion the work paper below and is the only amount that CCF is required to pay under the Master Agreement--as is documented in my analysis in the paper and the Master Agreement all other money comes from the City owned hospital, not CCF. Any claim to the contrary is simply misplaced and untrue.

The seven residential properties ($971K) and the community health center ($700K) were also returned and reported in 2015.

Further, the photo below is a working paper from State Auditor's Independent CPA firm and was sent to me by Jenn Pae herself on September 29, 2016 with an email that was prepared by the State Auditor's CPAs. I have forwarded this to you today. This public record shows that all properties (except the Curtis block and empty shell of the building) were booked as "Total Revenues" to the Lakewood Hospital Fund in 2015. The email and notes of the State Auditor's Independent CPA firm reference that the sale proceeds of the FHC site (Belle and Detroit) were sold on February 22, 2016, but were accrued and reported on the 2015 CAFR.

- IMG_1097.JPG (112.12 KiB) Viewed 6326 times

Please note the State Auditor's comments in RED below:

From: "Pae, Jennifer" <

Jennifer.Pae@lakewoodoh.net>

To: Brian Essi

Cc: 'Sujata Sulzer' <

ssulzer@jgzcpa.com>; Sarah Betzel <

sbetzel@jgzcpa.com>; "Butler, Kevin" <

Kevin.Butler@lakewoodoh.net>; "Petrus, Jeannine" <

Jeannine.Petrus@lakewoodoh.net>; "Schuster, Keith" <

Keith.Schuster@lakewoodoh.net>

Sent: Thursday, September 29, 2016 10:12 AM

Subject: FW: Questions Concerning Auditor's Report

Mr. Essi –

The following and attached are the city’s auditor’s response to your questions.

Jennifer Pae

Director of Finance

City of Lakewood

(216) 529-6092

http://www.onelakewood.com

From: Sarah Betzel [mailto:

sbetzel@jgzcpa.com]

Sent: Wednesday, September 28, 2016 1:37 PM

To: Pae, Jennifer

Cc: 'Sujata Sulzer'; Schuster, Keith

Subject: RE: Questions Concerning Auditor's Report

Hi Jenn,

See all my answers below in red. I believe I answered them all.

I have also attached an excel file I made when preparing the CAFR that summarizes the activity.

Let me know if you need any further information.

Thank you,

Sarah

From: Brian Essi

Sent: Wednesday, September 28, 2016 11:13 AM

To: Pae, Jennifer

Subject: Questions Concerning Auditor's Report

Dear Director Pae,

The Independent Auditor’s Report as part of the CAFR indicates that questions concerning the report should be directed to you. I have the following questions concerning your Comprehensive Annual Financial Report:

1. Page 19 of Independent Auditor’s Report refers to “$6.6 million as recognition of early termination of the 1996 Lease.” The MD&A section is a discussion and normally will be rounded, so this is the 6,644,731 as a rounded number. Pages 88 and 132 of the Independent Auditor’s Report refers to “a net amount of $6,644,731 per the master agreement from the Cleveland Clinic as recognition of early termination of the 1996 lease agreements and loss of future income tax.” Finally, the Master Agreement section 5.4 refers to a $6.8 million cash payment . Can you kindly explain the $200,000 and $155,269 discrepancies between the numbers on the Auditor’s Report?

The 6.8 is a gross number and the 6.6 is net. The difference are the various title and closing fees charged by title company at closing.

2. Under Section 6.2 of the Master Agreement, LHA was to pay $500K of the $7M demolition/redevelopment costs as of the date of FHC Site Sale which the Auditor’s Report indicates was February 22, 2016. Was the $500K paid on February 22, 2016?

JGZ doesn’t have this information If so, why was it not mentioned in the Auditor’s Report? Audit report covers 2015 and this was related to 2016 and subsequent event note is a summary If not, why wasn’t paid, if you know?

3. Can you kindly explain the $2,700,056 discrepancy between the $9,070,118 of “Total Revenues” referred to on pages 31 and 132 of the Independent Auditor’s Report and the “Total Revenues” of $11,770,174 referred to on page 16 of the Independent Auditor’s Report?

Pages 31 and 132 are on a cash basis (budgetary) and page 16 is on an accrual basis. There is a note that explains this on page 50

4. Can you kindly provide the aggregate or individual amounts for all or each the “seven residential properties the City previously had control over” referred to on page 19 of the of the Independent Auditor’s Report for 12/31/15? In other words, what dollar amounts are reported with those seven properties? See attached Also, was any dollar amount included for 12/31/14 for those seven properties?

No, not a part of the City as of that date

5. Can you kindly explain the $2,702,569 discrepancy between the “Contributions and Donations” of $6,644,731 reported on page 132 of the Auditor’s Report and the “Contributions and Donations” of $9,347,300 reported on page 26 of the Auditor’s Report?

The 6,644,731 is on a cash basis and the 9,347,300 is on an accrual basis. The main difference was an accrual entry for a debit to assets held for resale (for the 7 properties, medical office building and parking garage) and credit to contributions. The rest of the difference is that the revenue on the financials were shown as gross to revenue and the fees charged to expense.

6. What was the dollar amount included in the amounts reported on the Auditors for 12/31/14 for the “Medical office building located at 14601 Avenue” referred to on page 19?

Not related to 12-31-14 and included only in 2015 as assets held for resale of 1,576,000, the medical office building and parking garage are both included in this number

7. What was the dollar amount included in the amounts reported on the Auditors for 12/31/14 for the “parking garage located at 14601 Detroit” referred to on page 19?

See above

8. What was the dollar amount included in the amounts reported on the Auditors for 12/31/14 none and 12/31/15 for the “Community Health Center located at 1450 Belle Avenue” referred to on page 19?

700,000 as a capital grant and contribution

9. What was the dollar amount included in the amounts reported on the Auditor’s Report for 12/31/14 none and 12/31/15 for the “existing Lakewood Hospital site and all other property currently leased to LHA” and referred to on page 88 of the Auditor’s Report?

City prepared note. I think it would include the above or 2016 activity?

Could you kindly direct your answers to me via email

bjessi@sbcglobal.net or call me at 216 346-3434 with any questions you may have.

Thank you for your prompt attention to this matter.

Sincerely,

Brian J. Essi

Lakewood Resident