Page 1 of 1

Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Sun Oct 09, 2016 10:03 pm

by Brian Essi

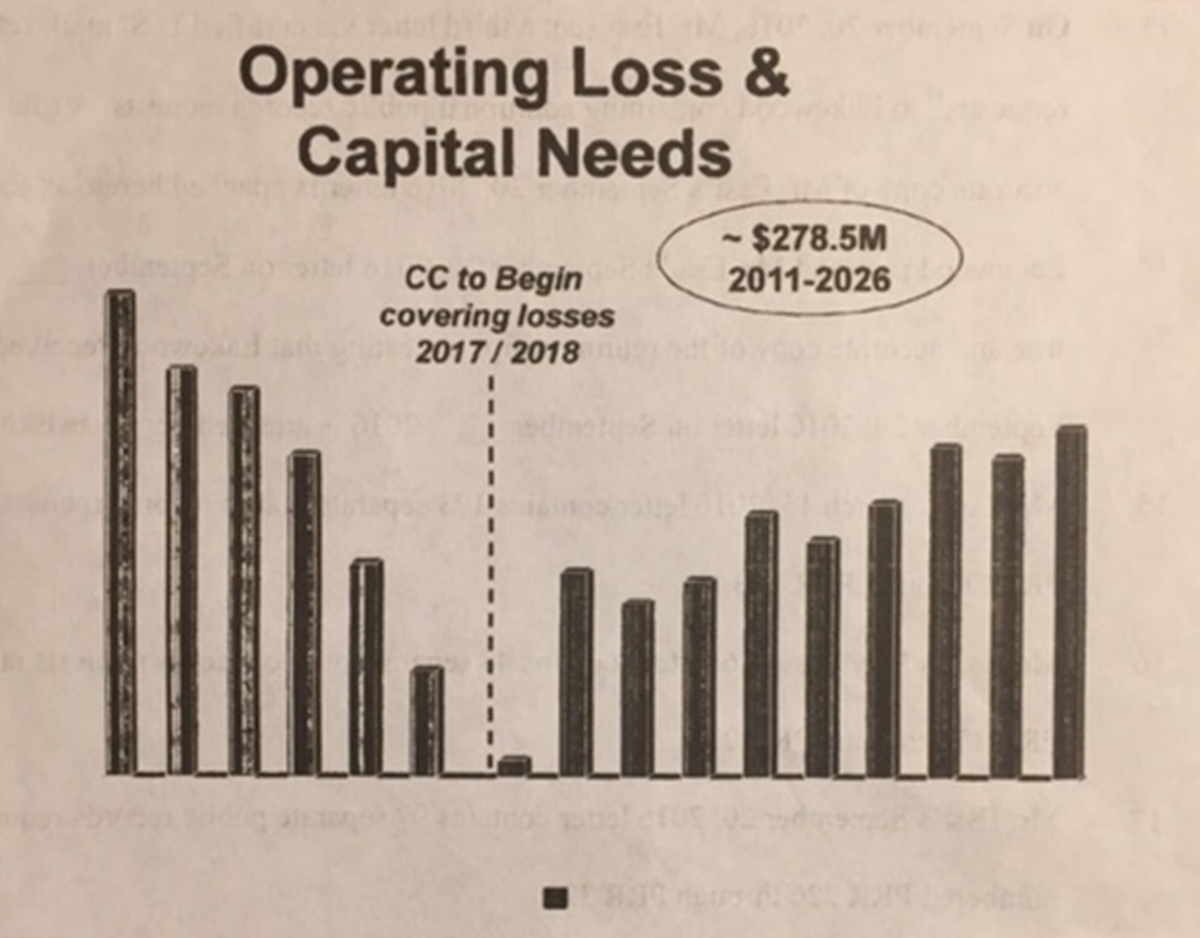

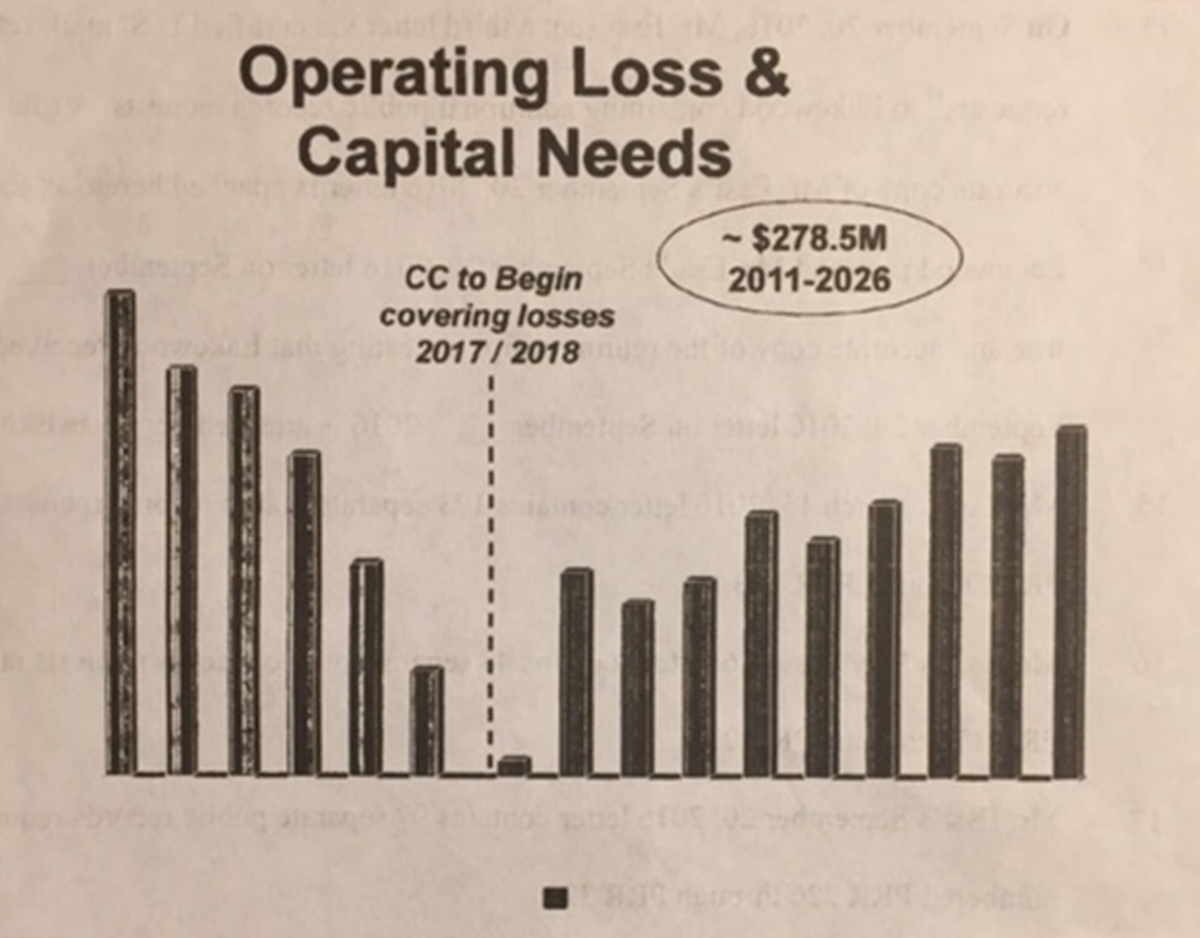

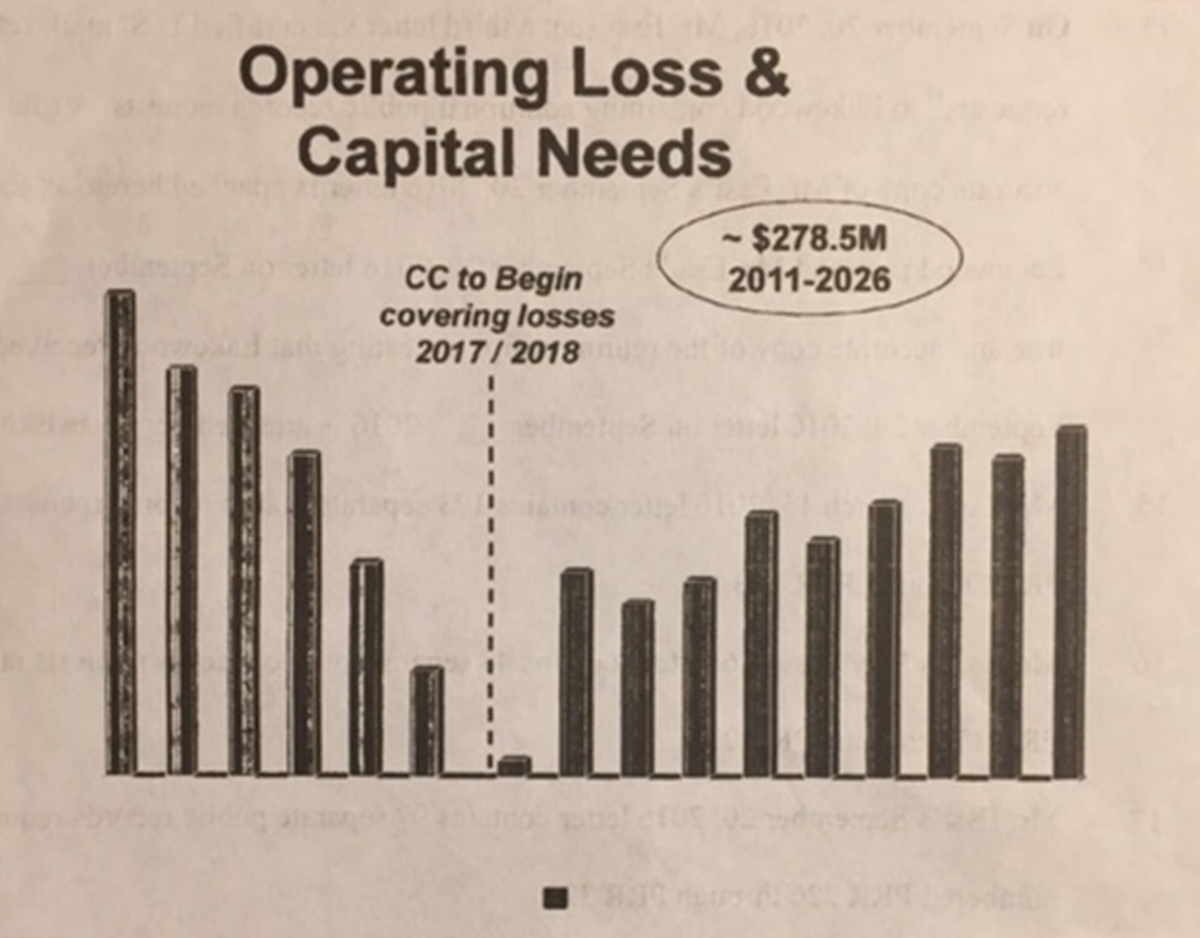

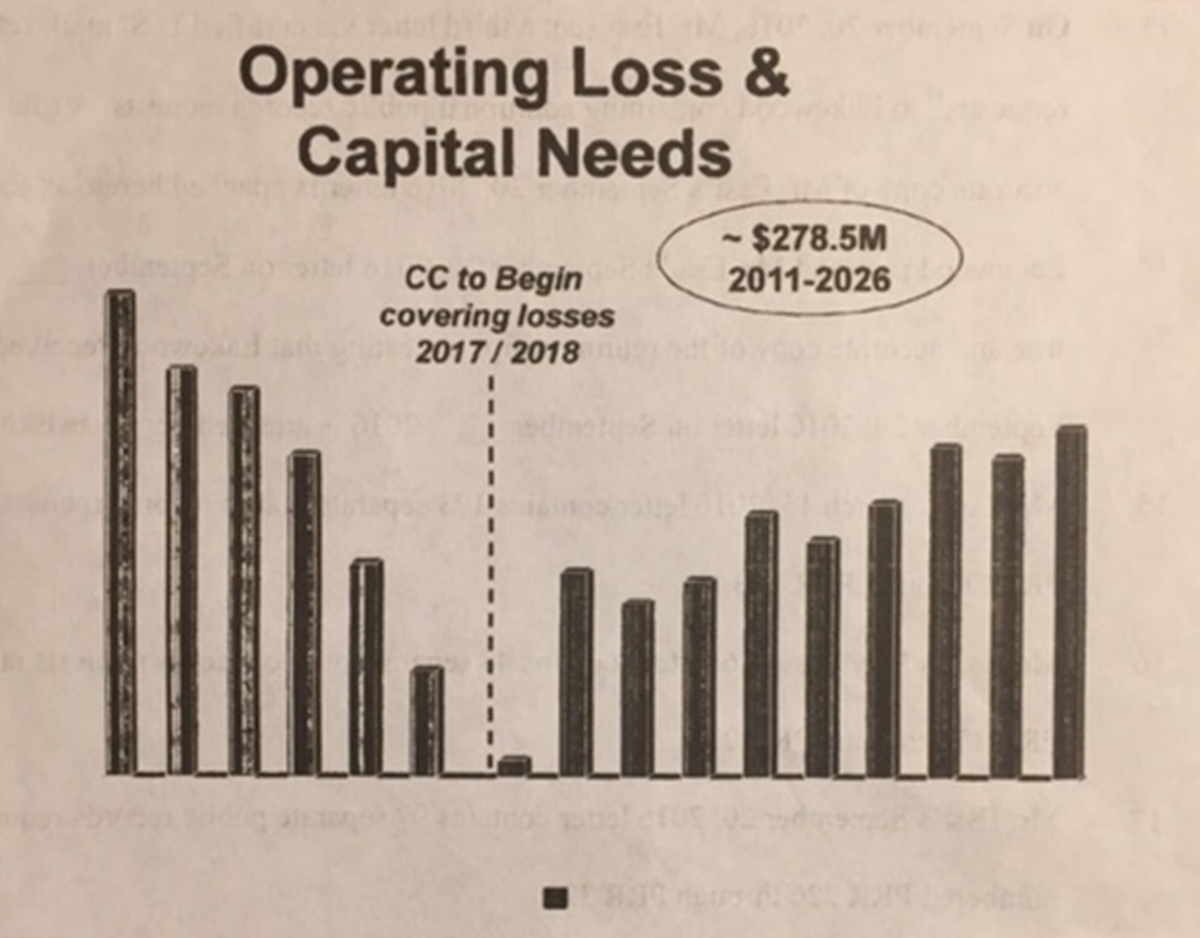

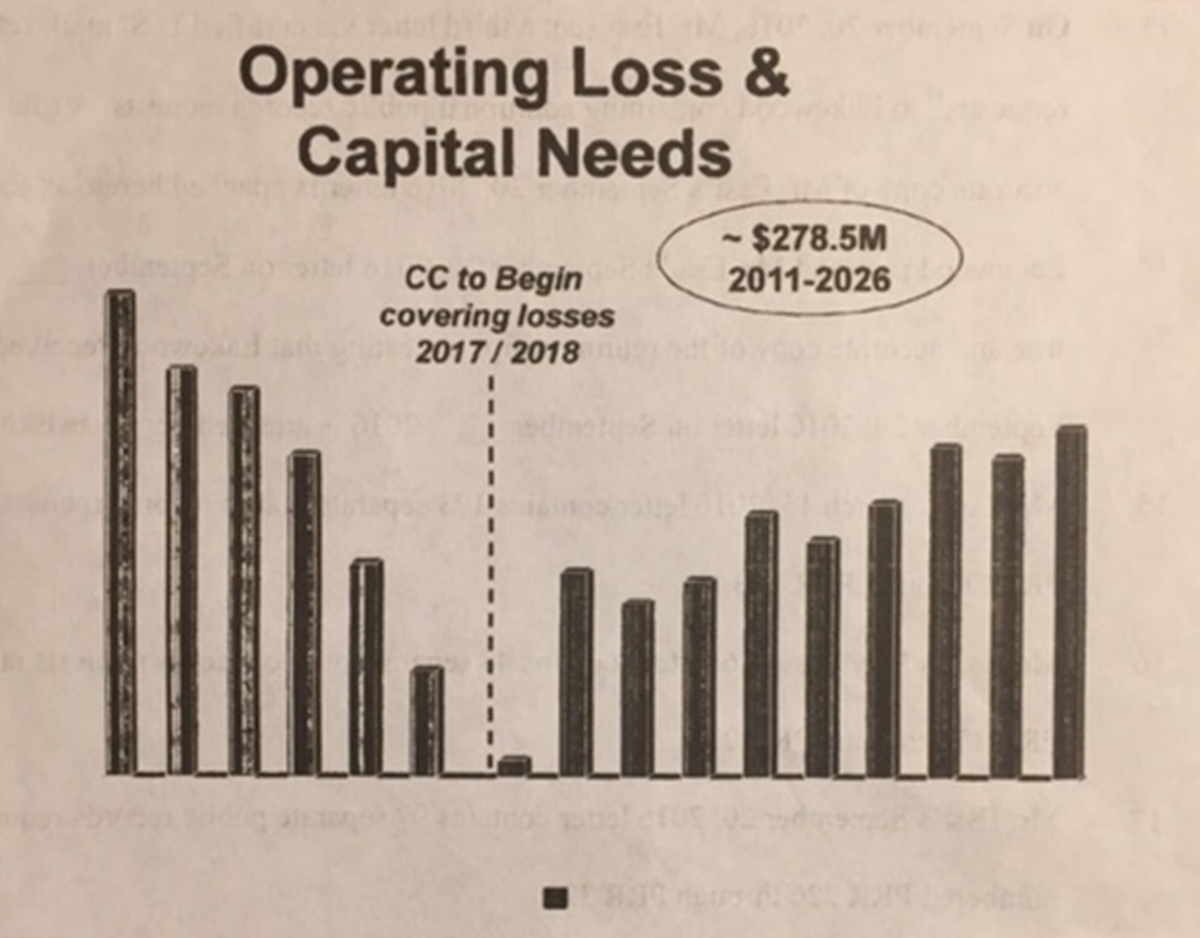

The secret internal planning document below prepared by the Clinic and filed in Court on October 5, 2016, proves that the Clinic was liable for $278 million required capital improvements and all losses at Lakewood Hospital through 2026 under the 1996 Lease.

Kevin Butler told us and City Council that the Clinic owed us nothing.

Kevin Butler decided to side with the Clinic and fight a lawsuit trying to return $300 million to Lakewood.

It is now beyond debate that Butler was dead wrong and has cost the City over $278 million.

Now that you know that even the Clinic believed it owed $278 million to Lakewood, ask your self the following questions:

1. Why did Butler side with the Clinic and give an opinion that was 180 degrees from the truth?

2. If you were Butler now, what would you do about your obvious mistake that has cost the taxpayers $278 million?

In my view, Kevin Butler should be praying that Issue 64 is defeated and the 1996 Agreement is restored.

Vote Against 64 to restore the Clinic's obligation to invest $278 million in Lakewood and to.......

save Kevin Butler

$278 million could be used to: 1. Build a hospital?; 2. build a Rec Center? 3. a new City Hall? 4. a new Justice Center.

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 9:00 am

by Lori Allen _

Brian, sadly your post does not shock me. Why would we assume that Butler would be any different from the rest at city hall? I believe that Summers and Extended Company are allegedly money laundering our entire city away and the hospital is just one part of the entire picture.

I encourage all Lakewood residents who would like to see these alleged crooks behind bars, should be out everyday in Lakewood spreading the word about what these alleged thieves have done to us, besides stealing our hospital.

A vote AGAINST 64 is our beginning to restoring honest, accountable government at city hall.

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 1:26 pm

by David Anderson

Mr. Essi –

I was under the impression that you had read the cash to debt ratio covenant in the Definitive Agreement that was in place prior to Council's action in December of 2015 (section 2.1.1). If you had, you would have realized that the Clinic had no liability in this area over $500,000 unless hospital debt dramatically increased which could only be done so by LHA with the permission of the Clinic (Section 1.1.1.6 of the previous definitive agreement).

The Clinic had its own out/veto clause in the 1996 agreement. This clause shielded the Clinic from liability over $500,000. Why would the Clinic have allowed the LHA to go back into long-term debt (the last of LHA’s notes were paid off in 2014) with only 11 years left on the lease? At the time of the out of context document you posted was created, the LHA had somewhere in the area of $12M in long-term debt and the Clinic helped to refinance this debt so that it would be paid off sooner.

Please read the previous Definitive Agreement and the 8/15 Huron Report specifically page 53.

In addition, in reference to your argument from last year, perhaps Ms. Harkness can persuade you that Generally Accepted Accounting Principles defines debt as including revolving working capital loans, debt incurred as a result of a pledge of accounts receivable, long term debt and current installments of long term debt. GAAP does not consider working capital/accounts payable as long-term debt and neither did the previous definitive agreement. On the point of looking for a way to make the Clinic liable in this area, are you suggesting that Council should have taken the Clinic to court and convinced a judge, somehow, to rule against the specifications of the contract/1996 agreement as well as Generally Accepted Accounting Principles? Really?

The bottom line on this is that you believe Council received bad counsel from Thompson Hine and Huron Consulting. Council pushed every legal theory with TH and Huron to the nth degree over the course of many, many months. As just one example, again, please review page 53 of the Huron Report dated August 14, 2015.

I have always respected you, Brian, but would not insult your intelligence by suggesting that you actually believe what you posted at the start of this thread.

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 1:44 pm

by Lori Allen _

I would like to see all official documentation that goes with this post, to better understand it.

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 1:50 pm

by Corey Rossen

David Anderson wrote:Mr. Essi –

I was under the impression that you had read the cash to debt ratio covenant in the Definitive Agreement that was in place prior to Council's action in December of 2015 (section 2.1.1). If you had, you would have realized that the Clinic had no liability in this area over $500,000 unless hospital debt dramatically increased which could only be done so by LHA with the permission of the Clinic (Section 1.1.1.6 of the previous definitive agreement).

The Clinic had its own out/veto clause in the 1996 agreement. This clause shielded the Clinic from liability over $500,000. Why would the Clinic have allowed the LHA to go back into long-term debt (the last of LHA’s notes were paid off in 2014) with only 11 years left on the lease? At the time of the out of context document you posted was created, the LHA had somewhere in the area of $12M in long-term debt and the Clinic helped to refinance this debt so that it would be paid off sooner.

Please read the previous Definitive Agreement and the 8/15 Huron Report specifically page 53.

In addition, in reference to your argument from last year, perhaps Ms. Harkness can persuade you that Generally Accepted Accounting Principles defines debt as including revolving working capital loans, debt incurred as a result of a pledge of accounts receivable, long term debt and current installments of long term debt. GAAP does not consider working capital/accounts payable as long-term debt and neither did the previous definitive agreement. On the point of looking for a way to make the Clinic liable in this area, are you suggesting that Council should have taken the Clinic to court and convinced a judge, somehow, to rule against the specifications of the contract/1996 agreement as well as Generally Accepted Accounting Principles? Really?

The bottom line on this is that you believe Council received bad counsel from Thompson Hine and Huron Consulting. Council pushed every legal theory with TH and Huron to the nth degree over the course of many, many months. As just one example, again, please review page 53 of the Huron Report dated August 14, 2015.

I have always respected you, Brian, but would not insult your intelligence by suggesting that you actually believe what you posted at the start of this thread.

Thank you. This helps me understand both sides much more clearly.

Corey

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 6:49 pm

by m buckley

Brian Essi wrote:The secret internal planning document below prepared by the Clinic and filed in Court on October 5, 2016, proves that the Clinic was liable for $278 million required capital improvements and all losses at Lakewood Hospital through 2026 under the 1996 Lease.

Kevin Butler told us and City Council that the Clinic owed us nothing.

Kevin Butler decided to side with the Clinic and fight a lawsuit trying to return $300 million to Lakewood.

It is now beyond debate that Butler was dead wrong and has cost the City over $278 million.

Now that you know that even the Clinic believed it owed $278 million to Lakewood, ask your self the following questions:

1. Why did Butler side with the Clinic and give an opinion that was 180 degrees from the truth?

2. If you were Butler now, what would you do about your obvious mistake that has cost the taxpayers $278 million?

In my view, Kevin Butler should be praying that Issue 64 is defeated and the 1996 Agreement is restored.

Vote Against 64 to restore the Clinic's obligation to invest $278 million in Lakewood and to.......

save Kevin Butler

$278 million could be used to: 1. Build a hospital?; 2. build a Rec Center? 3. a new City Hall? 4. a new Justice Center.

Kevin Butler - Indefatigable in his service to the 20 or so insiders that have their boot firmly on the throat of Lakewood.

There's a stench swirling around you Mr. Butler. You can't miss it. No one is going to forget it.

Release all PUBLIC records.

Vote against 64.

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 8:37 pm

by David Anderson

Lori Allen –

The following documents can be found by going to onelakewood.com, clicking on “Healthcare in Lakewood” under Most Popular pages then on “Historical Documents” under More Information. These have been there for 18-months or so.

- 1996 Lakewood Hospital Definitive Agreement – Sections 1.1.1.6 (“Integration of Lakewood and the CCF Health System”) and 2.1.1 (“Covenants and Rights of CCF”).

- 1996 Lakewood Hospital Lease Agreement – Section 2.2 – During the lease term, the Lessee (Lakewood Hospital Association) has sole and exclusive charge of the operation, maintenance, management, use, occupancy, and repair of the leased premises …

The 89 page Huron Report (8/14/2015) can be found at

http://www.onelakewood.com/wp-content/u ... report.pdf See page 53.

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 9:51 pm

by T Peppard

Brian Essi wrote:The secret internal planning document below prepared by the Clinic and filed in Court on October 5, 2016, proves that the Clinic was liable for $278 million required capital improvements and all losses at Lakewood Hospital through 2026 under the 1996 Lease.

Kevin Butler told us and City Council that the Clinic owed us nothing.

Kevin Butler decided to side with the Clinic and fight a lawsuit trying to return $300 million to Lakewood.

It is now beyond debate that Butler was dead wrong and has cost the City over $278 million.

The department of ethics should oversee such egregious behavior in a civil servant.

Re: Vote Against 64 to Restore CCF's $278 Million Rquired Investment in Lakewood

Posted: Mon Oct 10, 2016 10:17 pm

by Brian Essi

Dear Councilman Anderson,

I am afraid that you continue to be misled and have been given a faulty interpretation of the agreement that even the CCF planners and attorneys know is false as can be plainly seen in there document below.

This should be no surprise to you---I wrote to you, Mayor Summers and the rest of City Council on April 13, 2015 the language of the Definitive Agreement is plain and clear:

CCF is essentially a Guarantor of the Lease and is required to finance LHA’s losses to provide all of the ‘Required Services” by operating Lakewood Hospital through 2026 even if losses are $214M NPV as Subsidium forecasted.

Section 2.1.1 of the DA provides in part, “

CCF shall assure that Lakewood shall have a cash to debt ratio of 1:1 on a fiscal year basis…if it is determined that [LHA] does not meet such ratio, CCF shall advance sufficient funds to Lakewood to meet such ratio…any advances not repaid to CCF at such time as the [Lease] terminates shall be forgiven by CCF” In Section 1.8.1 of the DA, CCF agreed “

Notwithstanding any provisions in this Agreement to the contrary, CCF acknowledges and agrees that no provisions in this Agreement will cause [LHA] to take action or omit to take any action that could cause [LHA] to fail to perform or observe, or otherwise be in default of, any of its obligations under the Lease...”

FYI A CCF attorney who was involved in the formation of the agreement and several independent legal experts have confirmed this conclusion.

Indeed, Madeline Cain's November, 1996 press release confirms the same conclusion saying the Lease and Definitive Agreement: “

Provides City of Lakewood the right to require LHA to enforce provisions of the Agreement between LHA and CCF.”

The Huron Report is tainted and just parrots the secret information that CCF fed them--you should be made privy to Mr. Butler's admissions in responding my public records requests that the city was not privy to the information that CCF Fed Huron. Indeed, Butler is using Huron in litigation defending CCF. So Huron works for CCF and always has. Butler admitted this to me.

CCF admits it owes $278M in losses and capital improvements--I agree.