Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Moderator: Jim O'Bryan

-

Brian Essi

- Posts: 2421

- Joined: Thu May 07, 2015 11:46 am

Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

The following are facts taken directly from: (1) the audited financial statements of the City of Lakewood and LHA (2) the signed Master Agreement and (3) court documents the CCF was ordered to produce. They are facts about the Master Agreement and Issue 64---a BAD DEAL BY A BAD GOVERNMENT. We deserve a better deal. The following also shows how David Anderson's "accounting" makes no sense.

The Master Agreement Costs Taxpayer nearly $400M because CCF Pays $9.6M for108M worth of Hospital value, and escapes an admitted $278M required investment in Lakewood.

• The Cleveland Clinic Foundation admits liability to Lakewood of $278 million.

• Clinic records show Clinic will make $11.5 million additional profit each year into the future due to the hospital closure.

• State Auditor Report shows the Clinic paid only $9.6 million in the purchase of Lakewood Hospital

• In exchange for only $9.6 million, the Clinic received $108 million or 60% of $180 million fair market value of Lakewood Hospital.

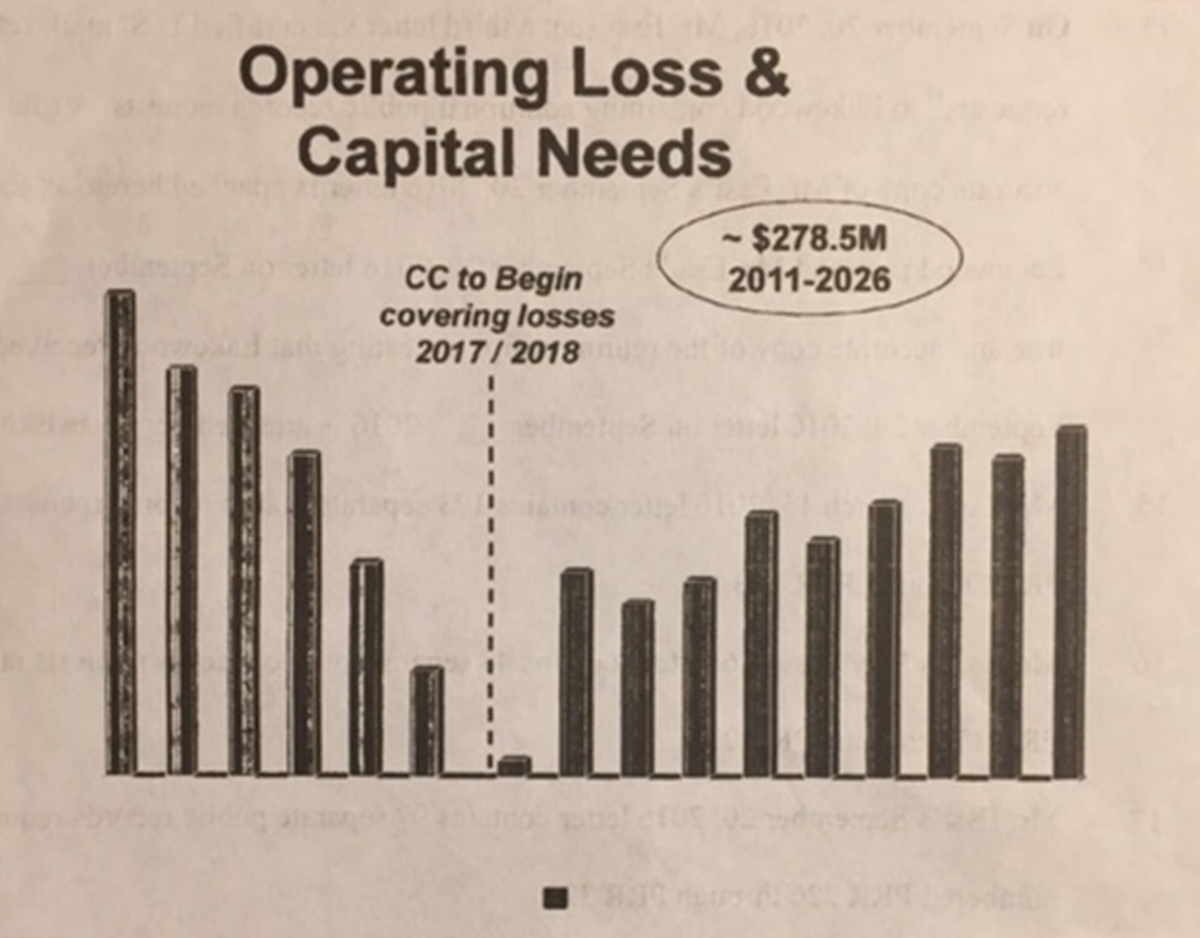

Clinic records prove the Clinic was Liable for $278 million prior to the Master Agreement

Secret internal planning documents prepared by the Clinic and filed in Court in the pending taxpayer lawsuit on October 5, 2016, prove that the Clinic was liable for required capital improvements and all losses at Lakewood Hospital through 2026. The Clinic’s own documents from 2011 declare the amount of the Clinic’s liability was $278 million beginning in 2017 which would have made Lakewood Hospital a state of the art hospital on par with the Clinic’s other hospitals.

This is at odds with Lakewood Law Director Kevin Butler’s September, 2015 legal opinion in which he claimed: “The Cleveland Clinic is not required to cover LHA’s operating losses. And neither LHA nor the Cleveland Clinic is obligated to invest significant capital money into the hospital facility-making major improvements at the hospital the city’s responsibility.” Butler’s legal opinion was the most important reason cited by City Council when they authorized Butler to negotiate the Master Agreement.

The Clinic will make over $11.5 million per year into the future from the Master Agreement

Other internal planning documents from 2011 just filed in Court, show that the Clinic planners “calculated the closing of Lakewood Hospital would result in a $11.5 million a year windfall” profit to the Clinic’s other hospitals because “CCF hospitals would capture an additional 5,000 inpatient visits per year with a closed Lakewood Hospital.” The documents show that as far back as 2011, the Clinic wanted to avoid its $278 million obligation by closing the hospital and harvesting the “premium payer mix” of Lakewood patients using the proposed family health center (FHC) to refer patients to the Clinic’s other hospitals.

On January 14, 2015, CCF’s Brian Donley (second in charge to Toby Cosgrove) referred to the FHC as a “specialty referral center.” Lakewood’s low-pay and self-pay patients would be referred out of Lakewood to Metro Hospital and other non-Clinic hospitals. The Master Agreement gives the Clinic a non-compete, or restrictive covenant (terms are interchangeable), that prohibits its competitors from operating at the former Lakewood Hospital site and assures the Clinic’s dominance in Lakewood as a “referral center.” The non-compete also guarantees that the land will be available to developers—which the court documents and sworn testimony reflect Summers and the Clinic planned since 2011, and earlier.

The State Auditor Report shows the Clinic paid only $9.6 million in the hospital “sale”

Public records released by Finance Director Jenn Pae on September 29, 2016 to support the City of Lakewood Comprehensive Annual Financial Review (CAFR), clearly demonstrate that the Cleveland Clinic paid only $9.6M to the city to purchase 60% of Lakewood Hospital’s $180 million FMV. The CAFR was prepared by the State Auditor’s office so the $9.6 million number is not subject to debate.

According to the CAFR, which was prepared with the participation of Mayor Summers and his administration: The Master Agreement disposed of "The City-owned Lakewood Hospital" (CAFR, page 47) in a “sale of Lakewood Hospital to the Cleveland Clinic” (CAFR, pages 42 and 44). The full CAFR can be found at https://ohioauditor.gov/auditsearch/Rep ... yahoga.pdf

In his January, 2016 deposition in the taxpayer lawsuit, when Summers (a defendant) was asked why there were no appraisals of hospital assets and why an investment banker was not hired to market the hospital, he testified: "We weren't selling this hospital.” [Summers transcript page 155; line 14.]

In the last issue of the Lakewood Observer, Councilman David Anderson wrote: “...the Lakewood Hospital Association’s net assets were valued at $128 million. The negotiated deal accounts for all of the $128 million.” However, it has been previously established through public records requests that neither the Mayor nor City Council conducted any appraisal of the hospital assets and Mr. Anderson’s $128 million number is the net “book value” of the assets and not a fair market value of the assets.

The Fair Market Value of Lakewood Hospital was $180 million

Nevertheless, now that it has been established that a “sale of Lakewood Hospital to the Clinic” took place, and that the Clinic paid only $9.6 million, the question remains:

What was the value of hospital assets sold to the Clinic for the $9.6 million the Clinic paid?

Investment bankers and hospital valuation experts generally agree that that the fair market value (FMV) for the sale of a hospital, is about 75% of annual “net revenues.” The logic behind this valuation approach is that the purchaser is paying for the revenue stream from existing patient lists as part of a going concern. Using this valuation method would produce a $180 million FMV when Lakewood’s $87 million liquid investment portfolio is included. This valuation is supported by the reported by the comparable sale price of St. John’s Hospital in Westlake to University Hospitals in 2015.

The Clinic Received $108 million of the Hospital FMV paying only $9.6 million

The Master Agreement terms and the CAFR together establish that the Clinic received $108 million of hospital FMV in exchange for $9.6 million:

1. $63.4 million—Net Value of the Non-Compete/Restrictive, together with all patient records and patient information, equipment, furniture, fixtures, bed licenses and tangible and intangible property.

2. $30 million--cash portion of the hospitals liquid investments.

3. $1.6 million--value of 1.8 Acres of cleared land on Belle and Detroit.

4. $13 million--FMV of Columbia Road surgical centr.

Total Cash, Property and Rights to Clinic: $108 million

Summary of how $180 million hospital value was distributed/sold

So here is the summary of what each party gets from the $180 million city-owned hospital:

1. $22 million returned to the City (12 %)

2. $16.5 million (net present value) to new foundation (9%).

3. $33.5 million released to Lakewood Hospital Foundation for private charitable use. (19%)

4. $108 million to the Clinic. (60%)

Total: $180 million

Issue 64 on November 8th gives voters the chance to vote for or against the Master Agreement.

Lakewood Voters must judge whether the Master Agreement is a good or bad financial deal for Lakewood; and a good or bad deal for their future healthcare.

The following details and analysis support whet I wrote above. It is intended to serve as a guide to simplify the overly complex terms of the Master Agreement that have been mischaracterized and misunderstood by various elected and public officials and others.

I. The 2015 CAFR (and the recently release records) show the city received $9.6 million from CCF for Lakewood Hospital, which includes:

1. $ 6,644,731 sale proceeds Columbia Road property (Per CAFR).

2. $1,400,00 promissory note from CCF for sale of Columbia Road (Per CAFR)

3. $1,576,000 for sale of Detroit/Belle land sold to CCF (Per CAFR).

Total Received from CCF: $9,620,731.

II. The Clinic gets $108 of the $180M FMV of the Hospital (60%).

The Master Agreement read together with the CAFR provides that the Clinic received $108 million of hospital fair market value (FMV) in exchange for $9.6 million. This includes:

5. $63.4 million—Net Value of the non-compete/restrictive covenant blocking all of its competitors from operating at the former hospital site, together with all patient records and patient information as well as a covenant together with equipment, furniture, fixtures bed licenses and tangible and intangible property.

6. $30 million — cash portion of the hospitals liquid investments (see below).

7. $1.6 million — value of 1.8 acres of cleared land on west side of Belle and Detroit.

8. $13 million — FMV of Columbia Road surgical center (CCF only paid $8M)

III. Overview of what each party gets from $180M FMV of Lakewood Hospital.

So here is the overview of what each party get from the $180M FMV of the city-owned hospital:

5. $7M Demolition payments to City.

6. $5.4M surrender of control of real estate owned by the City.

7. $9.6M for Columbia Road and Belle/Detroit Land paid to City (per CAFR).

8. $16.5M Net Present Value of payments to a new foundation, largely controlled by CCF.

9. $33.5M returned to Lakewood Hospital Foundation for private use.

10. $108 M — FMV of all assets transferred to CCF for $9.6M payment to city.

IV. According to the CAFR and the Master Agreement the City will receive only $22 million value for the hospital closing.

1. $8M sale proceeds Columbia Road property (per CAFR).

2 $7M as demolition payment toward tear down of hospital (from Master Agreement).

3. $1.6M for FHC Site land sold to CCF (Per CAFR).

6. $1M for seven residential properties (per CAFR).

7. $0.7M for existing community health center (per CAFR).

8. $3.7M estimated value of hospital site, subject to non-compete and CCF parking lot rights not returned to city until 2018.

Total to be received by City: $22M.

V. Lakewood Hospital had a fair market value of $180M:

1. Industry standards used by Investment Bankers:75% of 2014 net revenues of $124 million equals $93 million, plus investment portfolio of $87 million puts FMV of Lakewood Hospital at $180M.

2. Supporting the $93 million FMV is the 2015 announcement that University Hospitals (UH) had paid $90M for the smaller St. John’s Hospital in Westlake. UH received no liquid investments in that sale.

3. The Clinic will make $11.2 million profit per year—capitalized this supports the $93M valuation.

4. Subsidium — a conflicted expert hired by CCF placed an average FMV $71M Lakewood Hospital plus $87 million investments. $158M FMV.

VI. CCF receives $30M of LHA’s liquid assets.

1. $2.5M paid to CCF’s Cayman Islands insurance company to protect CCF.

2. $2.5 M paid to CCF to help CCF build parking lot owned by CCF.

3. $3.5 M to CCF for demolition of parking garage and medical building on CCF land.

4. $21.5 M to CCF as cash “dissolution distribution.”

Please Note CCF receives the direct benefit of $30M of cash and an indirect benefit of $16.5M by controlling the new foundation. Total cash assets benefiting CCF=$43.1

City receives only $7M from LHA liquid assets.

VII. Distributions from Hospital’s $87 M in Liquid Assets

1. $7M demolition payments to City.

2. $16.5M Net Present Value of payments to the new foundation, largely controlled by CCF.

3. $33.5M returned to Lakewood Hospital Foundation for private use.

4. $30M balance to CCF

The Master Agreement Costs Taxpayer nearly $400M because CCF Pays $9.6M for108M worth of Hospital value, and escapes an admitted $278M required investment in Lakewood.

• The Cleveland Clinic Foundation admits liability to Lakewood of $278 million.

• Clinic records show Clinic will make $11.5 million additional profit each year into the future due to the hospital closure.

• State Auditor Report shows the Clinic paid only $9.6 million in the purchase of Lakewood Hospital

• In exchange for only $9.6 million, the Clinic received $108 million or 60% of $180 million fair market value of Lakewood Hospital.

Clinic records prove the Clinic was Liable for $278 million prior to the Master Agreement

Secret internal planning documents prepared by the Clinic and filed in Court in the pending taxpayer lawsuit on October 5, 2016, prove that the Clinic was liable for required capital improvements and all losses at Lakewood Hospital through 2026. The Clinic’s own documents from 2011 declare the amount of the Clinic’s liability was $278 million beginning in 2017 which would have made Lakewood Hospital a state of the art hospital on par with the Clinic’s other hospitals.

This is at odds with Lakewood Law Director Kevin Butler’s September, 2015 legal opinion in which he claimed: “The Cleveland Clinic is not required to cover LHA’s operating losses. And neither LHA nor the Cleveland Clinic is obligated to invest significant capital money into the hospital facility-making major improvements at the hospital the city’s responsibility.” Butler’s legal opinion was the most important reason cited by City Council when they authorized Butler to negotiate the Master Agreement.

The Clinic will make over $11.5 million per year into the future from the Master Agreement

Other internal planning documents from 2011 just filed in Court, show that the Clinic planners “calculated the closing of Lakewood Hospital would result in a $11.5 million a year windfall” profit to the Clinic’s other hospitals because “CCF hospitals would capture an additional 5,000 inpatient visits per year with a closed Lakewood Hospital.” The documents show that as far back as 2011, the Clinic wanted to avoid its $278 million obligation by closing the hospital and harvesting the “premium payer mix” of Lakewood patients using the proposed family health center (FHC) to refer patients to the Clinic’s other hospitals.

On January 14, 2015, CCF’s Brian Donley (second in charge to Toby Cosgrove) referred to the FHC as a “specialty referral center.” Lakewood’s low-pay and self-pay patients would be referred out of Lakewood to Metro Hospital and other non-Clinic hospitals. The Master Agreement gives the Clinic a non-compete, or restrictive covenant (terms are interchangeable), that prohibits its competitors from operating at the former Lakewood Hospital site and assures the Clinic’s dominance in Lakewood as a “referral center.” The non-compete also guarantees that the land will be available to developers—which the court documents and sworn testimony reflect Summers and the Clinic planned since 2011, and earlier.

The State Auditor Report shows the Clinic paid only $9.6 million in the hospital “sale”

Public records released by Finance Director Jenn Pae on September 29, 2016 to support the City of Lakewood Comprehensive Annual Financial Review (CAFR), clearly demonstrate that the Cleveland Clinic paid only $9.6M to the city to purchase 60% of Lakewood Hospital’s $180 million FMV. The CAFR was prepared by the State Auditor’s office so the $9.6 million number is not subject to debate.

According to the CAFR, which was prepared with the participation of Mayor Summers and his administration: The Master Agreement disposed of "The City-owned Lakewood Hospital" (CAFR, page 47) in a “sale of Lakewood Hospital to the Cleveland Clinic” (CAFR, pages 42 and 44). The full CAFR can be found at https://ohioauditor.gov/auditsearch/Rep ... yahoga.pdf

In his January, 2016 deposition in the taxpayer lawsuit, when Summers (a defendant) was asked why there were no appraisals of hospital assets and why an investment banker was not hired to market the hospital, he testified: "We weren't selling this hospital.” [Summers transcript page 155; line 14.]

In the last issue of the Lakewood Observer, Councilman David Anderson wrote: “...the Lakewood Hospital Association’s net assets were valued at $128 million. The negotiated deal accounts for all of the $128 million.” However, it has been previously established through public records requests that neither the Mayor nor City Council conducted any appraisal of the hospital assets and Mr. Anderson’s $128 million number is the net “book value” of the assets and not a fair market value of the assets.

The Fair Market Value of Lakewood Hospital was $180 million

Nevertheless, now that it has been established that a “sale of Lakewood Hospital to the Clinic” took place, and that the Clinic paid only $9.6 million, the question remains:

What was the value of hospital assets sold to the Clinic for the $9.6 million the Clinic paid?

Investment bankers and hospital valuation experts generally agree that that the fair market value (FMV) for the sale of a hospital, is about 75% of annual “net revenues.” The logic behind this valuation approach is that the purchaser is paying for the revenue stream from existing patient lists as part of a going concern. Using this valuation method would produce a $180 million FMV when Lakewood’s $87 million liquid investment portfolio is included. This valuation is supported by the reported by the comparable sale price of St. John’s Hospital in Westlake to University Hospitals in 2015.

The Clinic Received $108 million of the Hospital FMV paying only $9.6 million

The Master Agreement terms and the CAFR together establish that the Clinic received $108 million of hospital FMV in exchange for $9.6 million:

1. $63.4 million—Net Value of the Non-Compete/Restrictive, together with all patient records and patient information, equipment, furniture, fixtures, bed licenses and tangible and intangible property.

2. $30 million--cash portion of the hospitals liquid investments.

3. $1.6 million--value of 1.8 Acres of cleared land on Belle and Detroit.

4. $13 million--FMV of Columbia Road surgical centr.

Total Cash, Property and Rights to Clinic: $108 million

Summary of how $180 million hospital value was distributed/sold

So here is the summary of what each party gets from the $180 million city-owned hospital:

1. $22 million returned to the City (12 %)

2. $16.5 million (net present value) to new foundation (9%).

3. $33.5 million released to Lakewood Hospital Foundation for private charitable use. (19%)

4. $108 million to the Clinic. (60%)

Total: $180 million

Issue 64 on November 8th gives voters the chance to vote for or against the Master Agreement.

Lakewood Voters must judge whether the Master Agreement is a good or bad financial deal for Lakewood; and a good or bad deal for their future healthcare.

The following details and analysis support whet I wrote above. It is intended to serve as a guide to simplify the overly complex terms of the Master Agreement that have been mischaracterized and misunderstood by various elected and public officials and others.

I. The 2015 CAFR (and the recently release records) show the city received $9.6 million from CCF for Lakewood Hospital, which includes:

1. $ 6,644,731 sale proceeds Columbia Road property (Per CAFR).

2. $1,400,00 promissory note from CCF for sale of Columbia Road (Per CAFR)

3. $1,576,000 for sale of Detroit/Belle land sold to CCF (Per CAFR).

Total Received from CCF: $9,620,731.

II. The Clinic gets $108 of the $180M FMV of the Hospital (60%).

The Master Agreement read together with the CAFR provides that the Clinic received $108 million of hospital fair market value (FMV) in exchange for $9.6 million. This includes:

5. $63.4 million—Net Value of the non-compete/restrictive covenant blocking all of its competitors from operating at the former hospital site, together with all patient records and patient information as well as a covenant together with equipment, furniture, fixtures bed licenses and tangible and intangible property.

6. $30 million — cash portion of the hospitals liquid investments (see below).

7. $1.6 million — value of 1.8 acres of cleared land on west side of Belle and Detroit.

8. $13 million — FMV of Columbia Road surgical center (CCF only paid $8M)

III. Overview of what each party gets from $180M FMV of Lakewood Hospital.

So here is the overview of what each party get from the $180M FMV of the city-owned hospital:

5. $7M Demolition payments to City.

6. $5.4M surrender of control of real estate owned by the City.

7. $9.6M for Columbia Road and Belle/Detroit Land paid to City (per CAFR).

8. $16.5M Net Present Value of payments to a new foundation, largely controlled by CCF.

9. $33.5M returned to Lakewood Hospital Foundation for private use.

10. $108 M — FMV of all assets transferred to CCF for $9.6M payment to city.

IV. According to the CAFR and the Master Agreement the City will receive only $22 million value for the hospital closing.

1. $8M sale proceeds Columbia Road property (per CAFR).

2 $7M as demolition payment toward tear down of hospital (from Master Agreement).

3. $1.6M for FHC Site land sold to CCF (Per CAFR).

6. $1M for seven residential properties (per CAFR).

7. $0.7M for existing community health center (per CAFR).

8. $3.7M estimated value of hospital site, subject to non-compete and CCF parking lot rights not returned to city until 2018.

Total to be received by City: $22M.

V. Lakewood Hospital had a fair market value of $180M:

1. Industry standards used by Investment Bankers:75% of 2014 net revenues of $124 million equals $93 million, plus investment portfolio of $87 million puts FMV of Lakewood Hospital at $180M.

2. Supporting the $93 million FMV is the 2015 announcement that University Hospitals (UH) had paid $90M for the smaller St. John’s Hospital in Westlake. UH received no liquid investments in that sale.

3. The Clinic will make $11.2 million profit per year—capitalized this supports the $93M valuation.

4. Subsidium — a conflicted expert hired by CCF placed an average FMV $71M Lakewood Hospital plus $87 million investments. $158M FMV.

VI. CCF receives $30M of LHA’s liquid assets.

1. $2.5M paid to CCF’s Cayman Islands insurance company to protect CCF.

2. $2.5 M paid to CCF to help CCF build parking lot owned by CCF.

3. $3.5 M to CCF for demolition of parking garage and medical building on CCF land.

4. $21.5 M to CCF as cash “dissolution distribution.”

Please Note CCF receives the direct benefit of $30M of cash and an indirect benefit of $16.5M by controlling the new foundation. Total cash assets benefiting CCF=$43.1

City receives only $7M from LHA liquid assets.

VII. Distributions from Hospital’s $87 M in Liquid Assets

1. $7M demolition payments to City.

2. $16.5M Net Present Value of payments to the new foundation, largely controlled by CCF.

3. $33.5M returned to Lakewood Hospital Foundation for private use.

4. $30M balance to CCF

David Anderson has no legitimate answers

-

Corey Rossen

- Posts: 1663

- Joined: Thu Nov 09, 2006 12:09 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

Corey Rossen

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

- Jim O'Bryan

- Posts: 14196

- Joined: Thu Mar 10, 2005 10:12 pm

- Location: Lakewood

- Contact:

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Corey Rossen wrote:People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

Talk is cheap, you any better?

Post the bad numbers, let's figure this stuff out.

.

Jim O'Bryan

Lakewood Resident

"The very act of observing disturbs the system."

Werner Heisenberg

"If anything I've said seems useful to you, I'm glad.

If not, don't worry. Just forget about it."

His Holiness The Dalai Lama

Lakewood Resident

"The very act of observing disturbs the system."

Werner Heisenberg

"If anything I've said seems useful to you, I'm glad.

If not, don't worry. Just forget about it."

His Holiness The Dalai Lama

-

Corey Rossen

- Posts: 1663

- Joined: Thu Nov 09, 2006 12:09 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

I am also not an accountant. Two wrongs would not make a right in this case.Jim O'Bryan wrote:Corey Rossen wrote:People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

Talk is cheap, you any better?

Post the bad numbers, let's figure this stuff out.

.

Anderson has proven him wrong, but you are blind to that.

Corey Rossen

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

-

Brian Essi

- Posts: 2421

- Joined: Thu May 07, 2015 11:46 am

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Mr. Rossen,Corey Rossen wrote:People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

I have degrees in Finance, Economics, Accounting and Law. I also studied International Finance and Economics and Multinational Corporations abroad.

I have spent over 30 years in in business law, which included business transactions, tax, securities, venture capital, turn arounds, loan work outs, fiduciary law and complex litigation involve forensic accounting. In fact, my first job out of law school was with the accounting firm Deloitte Haskins Sells in 1984--I was the first lawyer every hired in their tax department and I also received training in auditing and worked on audits in that "Big 8" accounting firm.

I have hired and work with many accounting and financial experts in the course of transactional analysis and complex financial litigation involving fiduciary duties. I have also worked with investment bankers and business brokers in helping my clients buy and sell businesses.

I know of what I speak--and I have a strong group of experts to back me up on my claims.

So once again, Mr. Rossen, you are wrong.

Just like Kevin Butler is wrong in his legal analysis--as the slide, prepared by CCF's Dr. Bronson--the second in charge at CCF proves beyond any doubt--Buter was dead wrong. CCF is and was liable under the 1996 Agreement for $278 million.

Are you part of the hoax too? What have you been promised from the crumbs left behind?

David Anderson has no legitimate answers

-

Lori Allen _

- Posts: 2550

- Joined: Wed Jan 28, 2015 2:37 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Brian,

Thanks for this information and for making it easier for us common folks to understand.

It appears to me that the numbers don't quite add up.

Mr. Butler appears to be way off the mark. I believe Summers and Company are trying to pull the wool over our eyes. Without the requested documents that several people have requested, more than once, it is hard to put everything together. Since it appears that Mr. Butler is choosing to ignore public records laws, I believe this might be a good time to file a complaint against him with the Bar Association.

Thanks for this information and for making it easier for us common folks to understand.

It appears to me that the numbers don't quite add up.

Mr. Butler appears to be way off the mark. I believe Summers and Company are trying to pull the wool over our eyes. Without the requested documents that several people have requested, more than once, it is hard to put everything together. Since it appears that Mr. Butler is choosing to ignore public records laws, I believe this might be a good time to file a complaint against him with the Bar Association.

-

Corey Rossen

- Posts: 1663

- Joined: Thu Nov 09, 2006 12:09 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Then why so many errors? You have been proven wrong and don't like it - people will understand that part of it.

Just because it is in your past does not mean you are good at it or qualified. I know several professional accountants, lawyers and other occupations who are not good at their jobs. No shame in it, but also no bragging rights.

Just because it is in your past does not mean you are good at it or qualified. I know several professional accountants, lawyers and other occupations who are not good at their jobs. No shame in it, but also no bragging rights.

Corey Rossen

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

-

Bill Call

- Posts: 3319

- Joined: Mon Jun 06, 2005 1:10 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Really? Give us examples.Corey Rossen wrote:People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

Anyway, what happened to the Lakewood Hospital Foundations $34 million?

-

Corey Rossen

- Posts: 1663

- Joined: Thu Nov 09, 2006 12:09 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Anderson has provided examples here on the Deck and elsewhere. Those who choose not see it, or who choose to overlook it, will continue to ask for examples.Bill Call wrote:Really? Give us examples.Corey Rossen wrote:People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

Anyway, what happened to the Lakewood Hospital Foundations $34 million?

Corey Rossen

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

-

Bill Call

- Posts: 3319

- Joined: Mon Jun 06, 2005 1:10 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Corey Rossen wrote:Anderson has provided examples here on the Deck and elsewhere. Those who choose not see it, or who choose to overlook it, will continue to ask for examples.Bill Call wrote:Really? Give us examples.Corey Rossen wrote:People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

Anyway, what happened to the Lakewood Hospital Foundations $34 million?

He does not mention the mysterious nee Foundation.

He does not mention the millions in medical equipment.

Anyway. What DID happen to all that money in the Lakewood Hospital Foundation?

-

Corey Rossen

- Posts: 1663

- Joined: Thu Nov 09, 2006 12:09 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

He does mention these topics. Those that choose to ignore them or do not like the answers will continue to ask for examples.Bill Call wrote:Corey Rossen wrote:Anderson has provided examples here on the Deck and elsewhere. Those who choose not see it, or who choose to overlook it, will continue to ask for examples.Bill Call wrote:Really? Give us examples.Corey Rossen wrote:People should be aware that you are not an accountant and that your accounting practices, understanding, and interpretations have fallen suspect to those in the know.

Anyway, what happened to the Lakewood Hospital Foundations $34 million?

He does not mention the mysterious nee Foundation.

He does not mention the millions in medical equipment.

Anyway. What DID happen to all that money in the Lakewood Hospital Foundation?

Corey Rossen

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

-

tom monahan

- Posts: 86

- Joined: Fri Apr 10, 2015 12:48 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Corey:

Could those people be Butler, Carson, O'Leary, Pae? Just saying...

Could those people be Butler, Carson, O'Leary, Pae? Just saying...

-

Brian Essi

- Posts: 2421

- Joined: Thu May 07, 2015 11:46 am

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Is anyone able to give one example where I have been in error?

ad ho·mi·nem

adverb & adjective

1.(of an argument or reaction) directed against a person rather than the position they are maintaining.

ad ho·mi·nem

adverb & adjective

1.(of an argument or reaction) directed against a person rather than the position they are maintaining.

David Anderson has no legitimate answers

-

Corey Rossen

- Posts: 1663

- Joined: Thu Nov 09, 2006 12:09 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Nope. Dean somebody. He lives on French Avenue, or at least that is where he told me to return the check to.tom monahan wrote:Corey:

Could those people be Butler, Carson, O'Leary, Pae? Just saying...

The other was something Petula(?). She was really classy on the phone. That conversation alone could sink SL for the way she treated the charity, the people in the charity and what she thought of the charity. I thought she was the head of SL, I'm guessing by these responses that I am wrong. Good thing, too, she offended a lot of people in one phone call with me.

It's a shame these people are representing SL. It would have been great if both organizations were at our event.

Corey Rossen

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

-

Corey Rossen

- Posts: 1663

- Joined: Thu Nov 09, 2006 12:09 pm

Re: Issue 64 is a BAD DEAL--The Master Agreement Costs Taxpayers Nearly $400 Million

Looking back in guessing I just answered questions from another thread or post.

So to answer your question on this thread...no. But knowing that Essi is a lawyer, and a losing one, I can say you and I both mutually know of one.

So to answer your question on this thread...no. But knowing that Essi is a lawyer, and a losing one, I can say you and I both mutually know of one.

Corey Rossen

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan

"I have neither aligned myself with SLH, nor BL." ~ Jim O'Bryan

"I am not neutral." ~Jim O'Bryan

"I am not here to stir up anything." ~Jim O'Bryan