David Anderson wrote:I received your second round of questions, Brian.

I don't live on social media, the deck or other places and have never been on Facebook (although my wife has a presence there which I think has a picture of me). Given all the vitriol I read for the first time yesterday in my response to my post on the deck, I am trying to figure out the point of a continuing our exchange. The table was provided along with my article but was not printed. Then, you call me out less than a day after your request to me for the table. Others offered their own assorted disparaging comments that "I can't" or "won't" provide the table which, again, I did along with the article.

So, do I engage with those who have stated continuously that I’ve acted illegally, immorally, unethically, dishonestly and un-democratically?

Regardless, I do not have all of the information in front of me now to respond to each of your second round of questions but have hit most below:

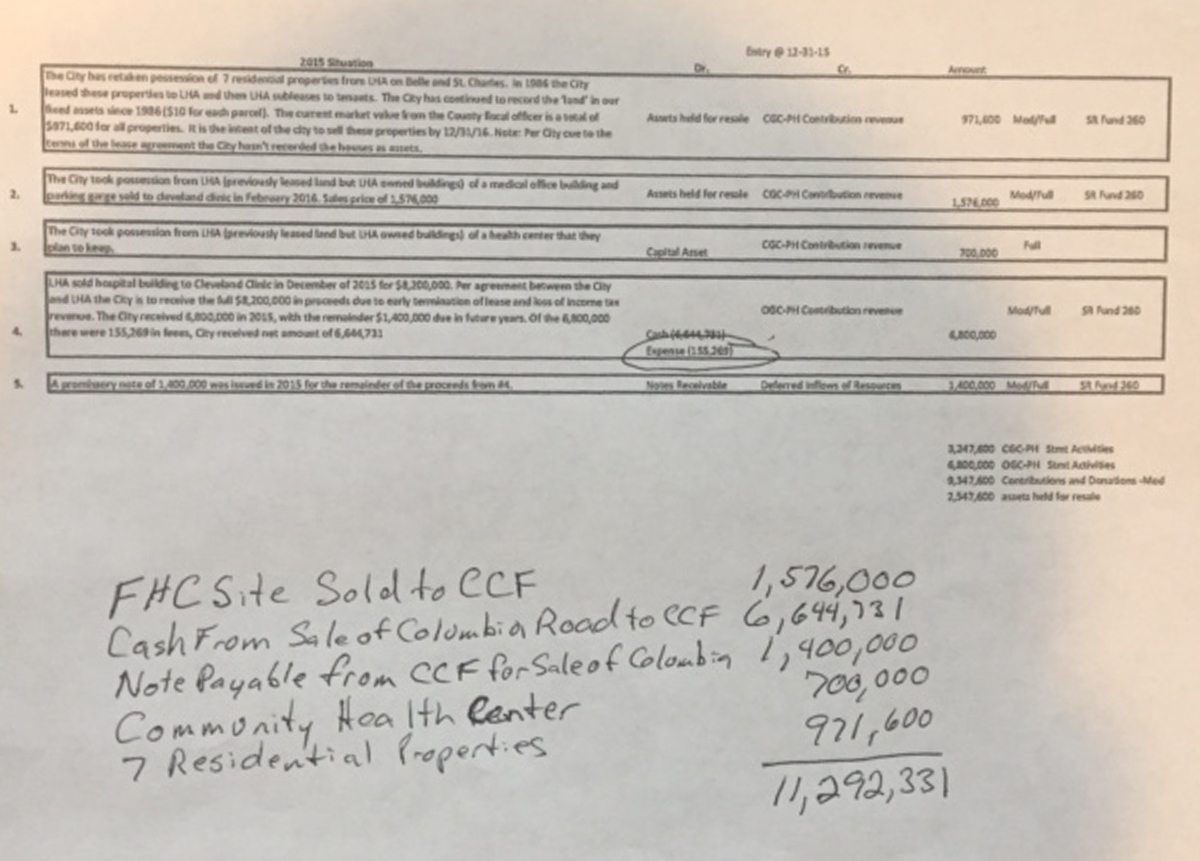

$20.0M valuation of Hospital Site – Book value of assets per LHA’s September 2015 financials totaled $37.951M: medical office was $5M; parking garage was $3M; 850 Columbia Road complex was $6M; equipment was $3M. This left $20.951M.

I think $20M is a more than fair valuation for Lakewood residents as the hospital building and parking garage needed up to $90M to make safe and competitive. Also, consider that since Council’s action, the Clinic bought the land upon which the new Family Health Center will be built for fair market value at $900,000 an acre. The City's land sitting under and around the Hospital building is 5.7 acres or a minimum of $5.13M of fair market value. In my mind, with up to $90M in needed repairs and upgrades, the Hospital building was the biggest liability to residents of the whole deal.

Regarding the $1.5M difference, we used a higher valuation in net assets that was on the LHA’s financials because we had a reaction that the 850 Columbia Road complex was likely worth more than $6M. The 6/2015 appraisal of 850 Columbia came in at $6.8M and it was sold to the Clinic for a total of $8.2M.

Accept it or not, the Clinic considered many of its operating documents pertaining to the wind down/transition costs as privileged information. However, the details of these were made available during the negotiating process. Not one person working on our side of the negotiating table thought that there were enough resources in LHA's assets to absorb all anticipated and unanticipated transition costs and were rightfully concerned that the City could be liable for these uncovered liabilities throughout 2016. In fact, the issue of uncovered transition costs was ultimately accepted by the Clinic which put up another $7.0M to cover this need. Acting when Council did relieved the City of any transition costs not covered by LHA assets from the moment Council's December 2015 action was signed by all parties.

I will post again to respond to your question regarding tenant relocation costs as I am not sure right now how much time, effort and capital were put into this process after Council agreed to this negotiated line item.

Yours in service,

David W. Anderson

Council Member, Ward 1

216-789-6463

Here is what I just emailed in response to the above post:

Dear Councilman Anderson (and Director Butler)

Thank you for your response above.

I am not responsible for the comments of others on the forum or elsewhere. Moreover, your suggestion that it was unfair to call out an elected official out on a public forum is misplaced—you wrote an article in a newspaper making claims in the course of a political debate which I find indefensible, but before I made my comments on the failings of your analysis, I wanted to find out where you were coming from first. May I also suggest that the notion that there should be something private about me as a citizen asking you as an elected official about a public matter that you wrote about publicly underscores part of the problem that is tearing our city apart.

Certainly I would hope that you as the most rational among the 7 who voted for the Master Agreement would agree that the public is entitled to all the relevant information and thinking that brought about that decision that is now the subject of a democratic vote.

Unfortunately, you have only responded to the first two of my 9 questions and those two answers are incomplete. Your answers also underscore that public records exist that were part of my public records requests—the precise requests that Mr. Butler has not yet fulfilled.

So let me respectfully reiterate the unanswered questions and partially unanswered question in the same numbered order as before and hope that we can together bring information to light that we can agree the public has a right to:

1. You wrote that you arrive at the “$20.0 Value of Hospital Site” from “

Book value of assets per LHA’s September 2015 financials totaled $37.951M: medical office was $5M; parking garage was $3M; 850 Columbia Road complex was $6M; equipment was $3M. This left $20.951M.” While I don’t agree with your methodology of “accounting” for assets, your answer left unanswered part of my original question: “Is there anything to substantiate that value by way of an appraisal?” You apparently have the records that detail the breakdown of the “$37,951M” book value of assets. Kindly verify with Mr. Butler that it is a public records and make that document public.

2. You answered my original question number 2 as follows

“Regarding the $1.5M difference, we used a higher valuation in net assets that was on the LHA’s financials because we had a reaction that the 850 Columbia Road complex was likely worth more than $6M. The 6/2015 appraisal of 850 Columbia came in at $6.8M and it was sold to the Clinic for a total of $8.2M.” What “

higher valuation” on what “

LHA financials” are you referring to here? I originally asked; "You mentioned “

anticipated appraisals” –can you share those “anticipated appraisals” with me?” I’m asking again, can you provide the “

higher valuation” on the “LHA financials” are you referring to here? Please verify with Mr. Butler that such documents are part of my unanswered document requests.

The following requests remain completely unanswered:

3. Transition Costs. Can you provide any detail for the breakdown of what you claim is “$20.1 LHA portion of transition costs including insurance, pensions obligations, malpractice insurance, tenant relocation and miscellaneous costs”? This is a lot of public money to be explained with such a few vague terms.

4. Clinic’s Absorption. Its seems to me that the “7.0 Demolition/rebab funds to the city” and the “7.0 Clinic’s absorption of transition costs not covered by 20.1 above” are related and may be the same money. Do you have anything to back up the “7.0 Clinic’s absorption” figure?

5. Transition Costs. What is the difference between the term “transition costs” you use and the “wind down” costs in the Master Agreement?

6. Pension Obligations. The 2015 E & Y LHA Financial Statements in footnote 13 describes the pension obligations of LHA and clearly states: “Included in the Hospital’s salaries, wages and benefits is retirement expense pertaining to the defined contributions plans of approximately $2.5 million …in 2015.” In other words, there is no balance sheet liability or other liability for pensions—that amount has been paid and is zero. Can you substantiate any other pension obligations that weren’t paid already? If so, why didn’t E &Y mention or footnote them in its audit that was not completed until May, 2016?

7. Insurance. The Master Agreement Section 9.12 requires LHA to pay a $2.5M premium (to CCF’s for-profit offshore insurance company in the Cayman Islands) to protect CCF employees, executives and CCF Trustees, but Mr. Butler has heretofore refused to produce any evidence by way of public records that such policy even exists or that the premium has even been paid. That $2.5M premium paid to CCF was to cover all of LHA insurance needs. Do you have any evidence that of any other insurance expenses over the $2.5M that would be considered “transition costs”? If so, why didn’t E &Y mention or footnote these insurance expenses in its audit that was not completed until May, 2016?

8. Tenant Relocation Costs. What is the amount of tenant relocation expenses? FYI I am told many relocated tenants that they received nothing to relocate and many tenants were CCF affiliates.

9. Operating Losses. Per the 12/31/15 audited financial statements EBIDA losses for the year were $8.1M and per the 9/30/15 statement they were $ 4.5M through 9/30/15. So the $4.5M was already taken out of the net assets as of 9/30/15. 8.1 minus 4.5 =$3.6. It is clear there could be only $3.6 M of losses in the 4th quarter of 2015. As we know, the hospital shut down quickly by February 4, 2016 and many employees were let go or reassigned at Christmas---the January, 2016 losses could likely not have exceeded $1.2M. So it appears the maximum total losses from 9/30/15 through the hospital closing would be about $4.8M. How did you arrive at the “10.0 Operating Loss” and what period does that cover? Do you have anything to substantiate that amount.

I await your further reply.

Thank You.

Brian Essi

Lakewood Resident